Magento Indian GST Extension

Magento Indian GST extension helps merchants apply GST to goods or services by calculating tax rates defined by the Indian Government.

- Apply GST for particular categories, particular products or all products.

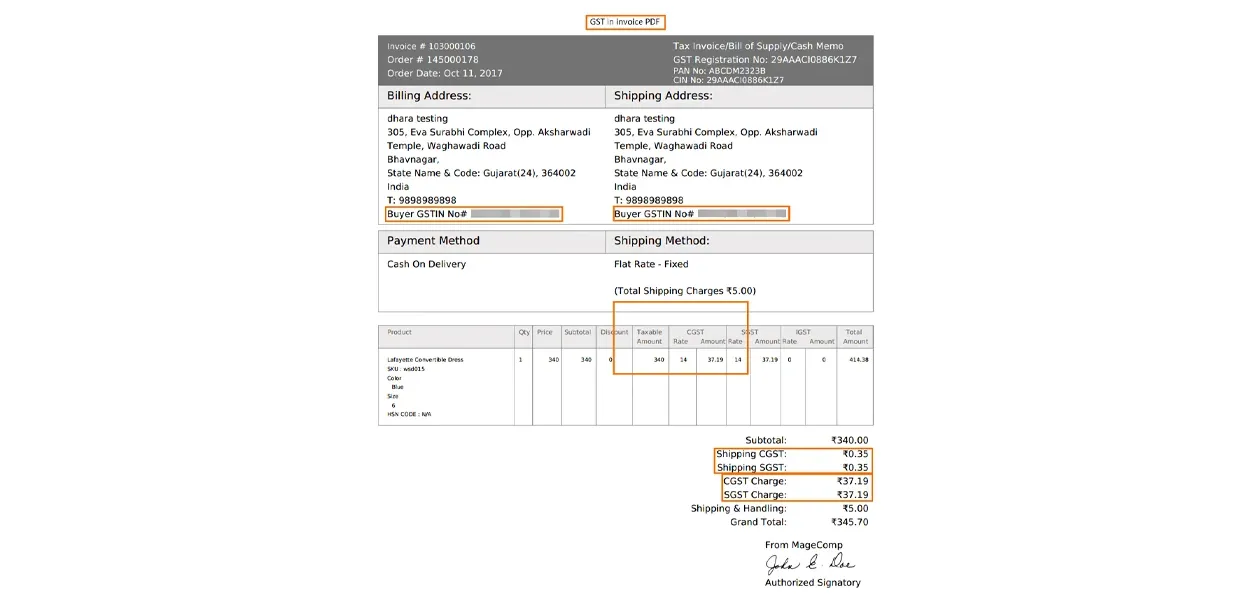

- Specify GSTIN, CIN & PAN number in Magento order details.

- Set GST rate for multiple products by uploading CSV file.

- Set product prices including or excluding GST tax rates.

- Generate order-specific & product-specific GST reports as per your needs.

- Create GST order report for specific date intervals.

- Decide minimum price to calculate GST for products.

- Configure tax rate in percentage for GST to be applied.

- Upload digital signature to invoice PDF.

- Get buyer GSTIN from storefront.

30 DAY

MONEY BACK

1 YEAR

FREE UPGRADE

1 YEAR

FREE SUPPORT

Indian Government launched GST (Goods & Services Tax) for replacing all the various taxes with a single tax which has considerably affected eCommerce market. Online Magento stores are in a quick race to implement GST rules in their business and make stores GST-ready.

Considering this fact, MageComp has come up with Magento Indian GST extension that helps create rules & rates and apply GST to store products and services offered by your Magento store. This extension sets default tax as GST and all tax operations will automatically be aligned based on GST standards and norms.

Why Choose MageComp’s Magento Indian GST Extension?

- Apply GST to all products storewide, to specific products or specific categories.

- Add GSTIN, CIN & PAN number to show in order detail & PDF invoice.

- Set minimum product price to apply GST rate.

- Set product prices including or excluding tax to calculate GST.

- Set GST rate for the product prices below the set minimum product price.

- For e.g, minimum price = ₹1000. If you want to apply GST according to product price and in case discount is applied hence GST is calculated based on set amount.

If product price + discount < ₹1000 : 5% (2.5% CGST + 2.5% SGST)

If product price + discount > ₹1000 : 12% (6% CGST + 6% SGST)

- For e.g, minimum price = ₹1000. If you want to apply GST according to product price and in case discount is applied hence GST is calculated based on set amount.

- UTGST is automatically applied to union territories.

- Enable or disable buy GST on frontend.

- Get buyer's GSTIN if required and show along with order details.

- Upload image and set text for digital signature.

- Apply GST in shipping charges including or excluding GST.

- Order view, invoice, credit memo, shipment, new order email and PDFs include GST shown in detail.

- Bifurcation of SGST and CGST in order details.

- SGST, CGST, and IGST are automatically calculated and added to Magento order subtotal.

- Generate GST report for both order-wise & product-wise.

Version 1.1.1 Date : 27-12-2018

- Added GST support for Bundle Products

- Minor bug fixes

Version 1.1.0 Date : 23-11-2018

- Implementation of UTGST tax

- Easy Navigation and User improvements

Version 1.0.14 Date : 10-09-2018

- Minor bug fixing

Version 1.0.13 Date : 26-06-2018

- Added backend support for generating GST report orderwise & productwise

Version 1.0.12 Date : 09-04-2018

- Minor bug fixing & User improvements

Version 1.0.11 Date : 28-02-2018

- Resolved Multi currency issue on cart page

Version 1.0.10 Date : 05-12-2017

- Added Form Key in Billing.phtml and Shipping.phtml based on latest patch rules

- Custom options and SKU have been added in order details

- Duplicate states selection issue is resolved

- Resolved State code no display issue in order PDFs

- Issue with table format when having 2 pages in invoice PDF solved

Version 1.0.9 Date : 11-10-2017

- Now enable GST on Shipping charges as well

- Added CIN Number to include in various order documents

- State name and code is added to show in invoice PDF

- Minor bug fixes

Version 1.0.8 Date : 27-08-2017

- Added field of PAN number to show in invoice PDF

- Option to add digital signature image and text

Version 1.0.7 Date : 18-08-2017

- Added Telangana state in business origin

- Minor bug fixing

Version 1.0.6 Date : 11-08-2017

- GST extension is now compatible with credit memo

- Minor bug fixing

Version 1.0.5 Date : 03-08-2017

- Solved issue related to currency symbol(₹) in invoice PDF

- Option to enable or disable buyer GST on frontend

- A separate tab in categories for GST settings

- Moved GST related settings for products from General to Price tab

Version 1.0.4 Date : 28-07-2017

- Minor bug fixes and label changes

Version 1.0.3 Date : 26-07-2017

- Added tax rate slab of 3%

- Option to set minimum product prices to apply tax rates

- Set tax rate to apply for product prices below set minimum price

Version 1.0.2 Date : 20-07-2017

- Now set product prices including or excluding tax to calculate GST

Version 1.0.1 Date : 18-07-2017

- Added GSTIN number field in backend to show along with order details

- Added field in frontend to get buyers' GSTIN if applicable

- Minor refinements