Magento 2 Indian GST Extension

Magento 2 Indian GST extension helps you auto-calculate tax rates and apply GST rules based on the Indian Government to make your Magento 2 stores GST-ready.

- Apply GST charges to specific products & categories or all products.

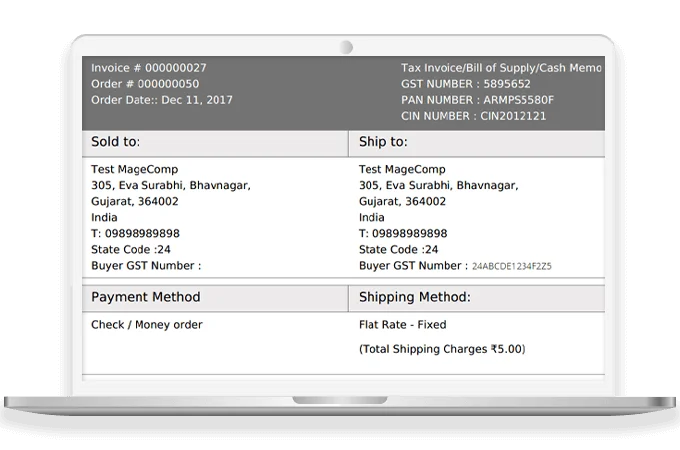

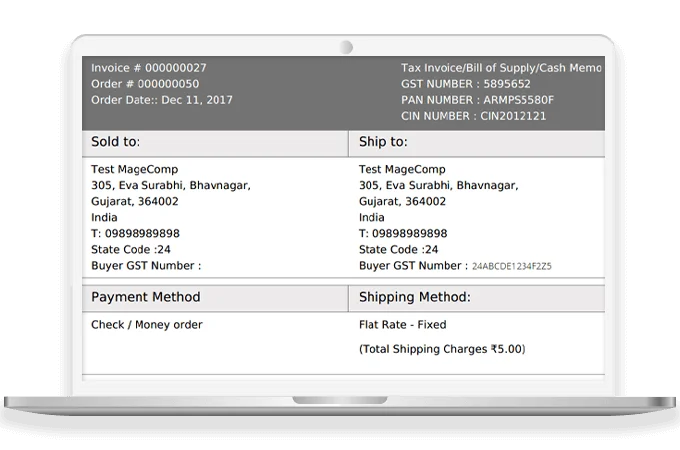

- Specify GSTIN, PAN & CIN number on order details.

- Select GST rate in percentage.

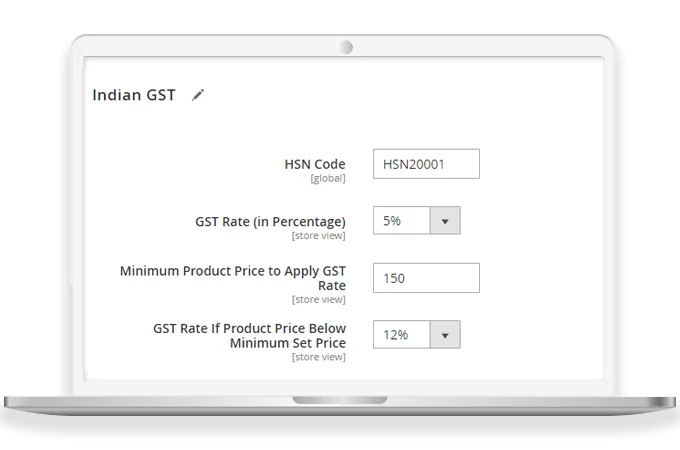

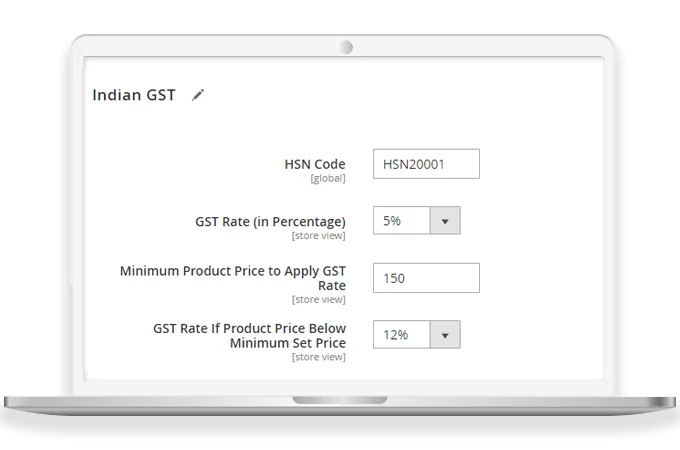

- Enter minimum product price to calculate GST rate.

- Decide GST rate for products whose price is below predefined minimum price.

- Upload CSV file to set GST rate for multiple products.

- Set product prices (incl. & excl.) GST tax rates.

- Generate order-specific & product-specific GST report.

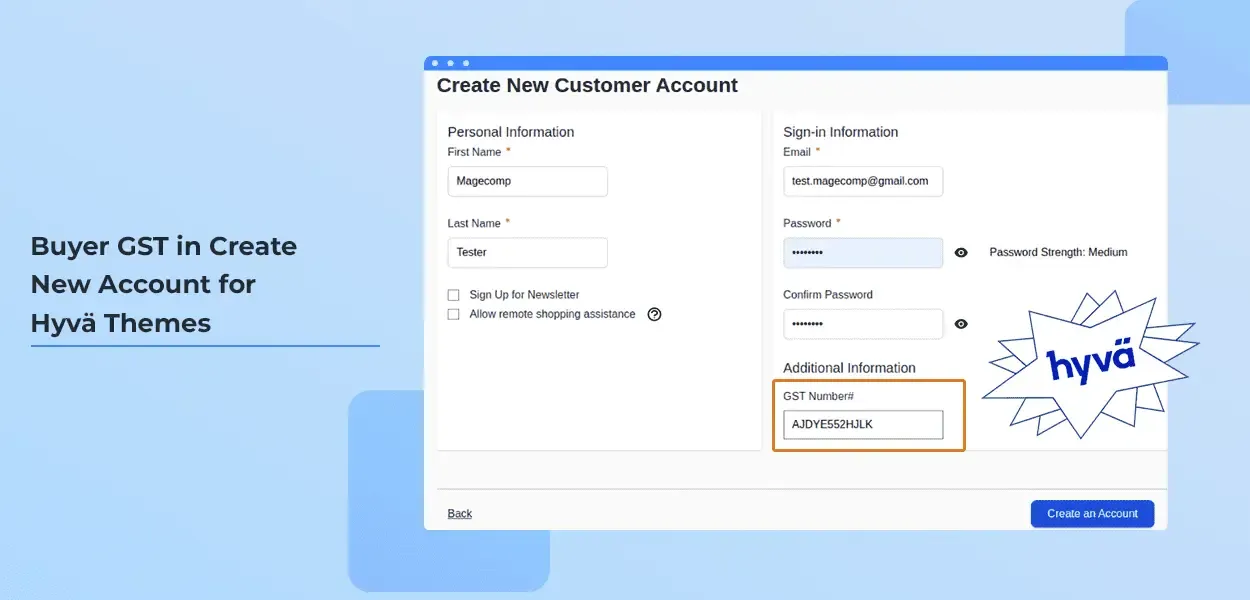

- Setting for showing buyer GSTIN on frontend.

- Upload digital signature to PDF invoices.

- Set custom signature text to show on PDF invoices.

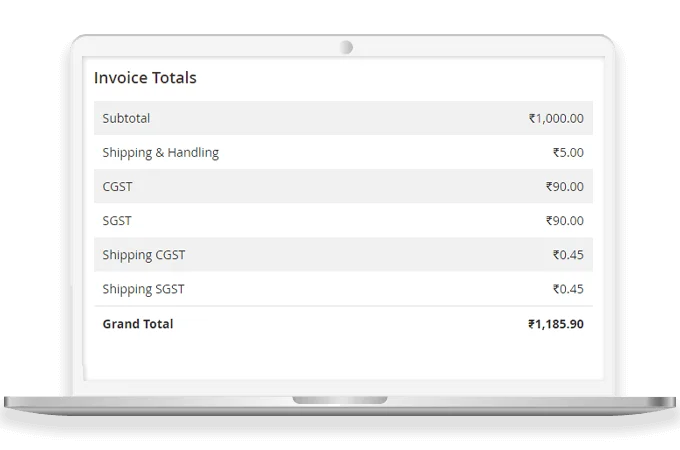

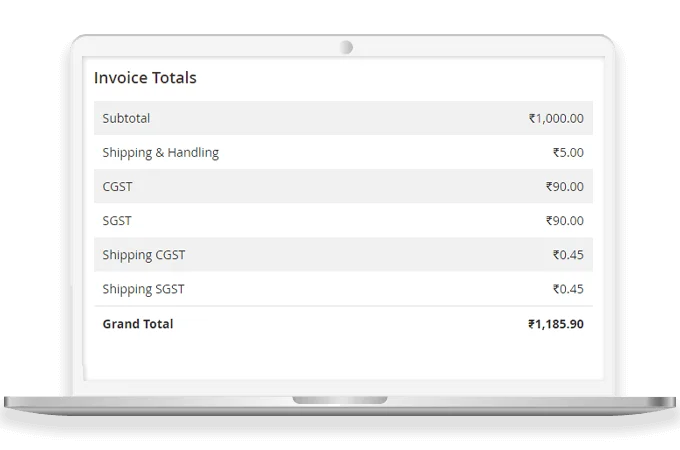

- Apply GST on shipping charge (including or excluding tax).

- REST API Available / GraphQL API Available.

- Hyvä Addon Available.

- Compatible with Hyvä Luma Checkout / Hyvä Checkout.

30 DAY

MONEY BACK

1 YEAR

FREE UPGRADE

1 YEAR

FREE SUPPORT

The Indian Government presented the GST (Goods and Services Tax) in July 2017 & established GST Laws. Better known as One Nation, One Tax is the core reason for the GST rollout that becomes a replacement to all existing different taxes. After the declaration of Indian GST, maximum online store merchants took necessary steps to apply GST to all products they sell online.

The Indian GST has affected eCommerce to compel and implement rules as per GST. GST is among the most complex tax systems that are designed to improve taxes collection & boost economy through a uniform tax rate. There are many people who have difficulties understanding Indian GST as it's a bit complex in calculating the GST. Many Magento 2 store owners are facing issues implementing the Indian GST in their stores.

MageComp's Magento 2 GST extension can auto-create GST rules & rates and apply them to goods and services being sold on your Magento store. In this extension, all the tax rules and operations have been aligned to GST standards. Magento 2 GST also displays the GST summary in all order documents (invoices, shipments, credit memos etc). From the backend of Magento 2 GST plugin, store admin can add GSTIN, CIN, PAN number or digital signature to display with every order details.

Note

Keep using the updated extension timely for benefitting the latest updates presented by the India Government.

Benefits of Magento 2 Indian GST Extension

Automate Whole GST Process & Stay Free

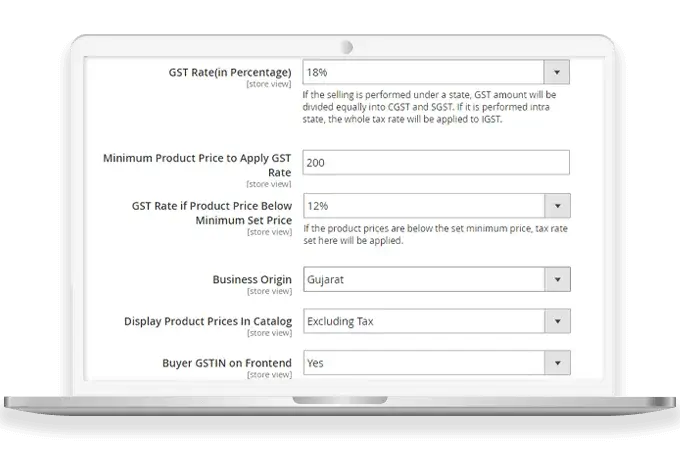

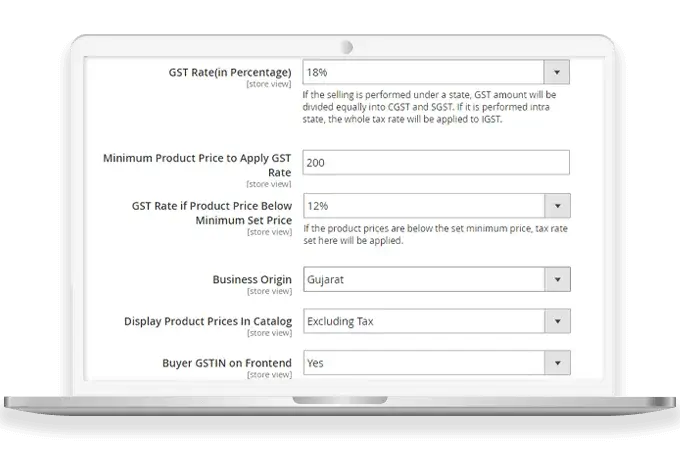

The extension completely complies with Indian administration standards to calculate applicable CGST, SGST & IGST taxes according to your sale type within the State (CGST + SGST) or another State (IGST) using backend defined tax slabs.

Moreover, you can display store product prices with inclusive or exclusive of GST charges. It helps your customers get better idea of product price and tax rates.

Option Set Minimum Price to Apply GST

Using the backend options, you can set the minimum product price to apply and calculate GST charges according to your need. You have an option to different GST rates for the products that fall under that minimum product price.

GST Summary for Better Understanding

The extension auto-calculates GST tax rates and display its bifurcation including CGST, SGST & IGST in all generated order details including order view, invoice, credit memo, shipment, new order email, and PDFs.

Showcase GST Number in Every Document

The extension displays your GSTIN, CIN & PAN number in various generated order documents. Also, you can also upload an image or text as a part of digital signature to show in the invoice PDF.

Generate GST Reports as Per Need

As a Government taxpayer, you require to submit & file to the tax administrative authorities of India. That's why we have added the functionality of generating GST reports by making of selecting specific days and exporting it in CSV Format.

Why Choose MageComp’s Magento 2 Indian GST Extension?

- Apply GST to all products or products under specified categories.

- Specify GSTIN number to show in order details.

- Add CIN & PAN number to mention order documents.

- Set minimum product price to apply GST rates.

- Import product-specific GST by importing CSV file.

- Set Indian GST rate for product prices below specified minimum price.

- Set product prices as including or excluding GST rates.

- Set the business origin to apply IGST (i.e Interstate Magento GST).

- Upload image and set text for digital signature.

- Display detailed tax rates in order view, invoice, credit memo, shipment, new order email & PDFs.

- Show Indian GST bifurcation of SGST and CGST.

- Auto calculation of SGST, CGST, and IGST based on product selection.

- Apply shipping charges including or excluding GST.

- Generate order-specific or product-specific GST report.

- No manual efforts required to calculate GST.

- Installation via Composer.

- Set GST Number field as optional or required in the Create New Account.

Version 2.1.4 Date : 04-10-2025

- Minor bug fixing

Version 2.1.3 Date : 12-04-2025

- Improved REST API and GraphQL API

- Compatible with Magento 2.4.8 version

Version 2.1.2 Date : 30-05-2024

- Compatible with Magento 2.4.7 version

- Minor bug fixing

Version 2.1.1 Date : 09-02-2024

- Improved REST API and GraphQL API

- Minor bug fixing

Version 2.1.0 Date : 06-06-2023

- Improved REST API and GraphQL API

- Compatible with Magento 2.4.6 version

- Minor bug fixing

Version 2.0.9 Date : 23-02-2023

- Minor bug fixing

Version 2.0.8 Date : 19-12-2022

- Compatible with the latest Magento 2.4.5 version

- Minor bug fixing

Version 2.0.7 Date : 02-08-2022

- Minor bug fixing

Version 2.0.6 Date : 20-06-2022

- Added REST API and GraphQL API

- Compatible with Bundled Product

- Compatible with the latest Magento 2.4.4 version

- Compatible with Magento Coding Standards

Version 2.0.5 Date : 14-04-2022

- Compatible with Magento 2.4.3 latest Magento version

- Minor bug fixes

Version 2.0.4 Date : 16-10-2021

- Solved Shipping GST Charge issue

- Minor Bug Fixing

Version 2.0.3 Date : 15-07-2021

- Now, Compatible with All types of Products i.e.(Grouped Product, Bundle Product)

- Minor Bug Fixing

Version 2.0.2 Date : 16-02-2021

- Added QR Code feature with PDF file

- Minor Bug Fixing

Version 2.0.1 Date : 10-11-2020

- Solved & Update Invoice PDF Issue

- Fixed Issue for Discount Amount issue

- Fixed Issue with Getting Customer Account GST number

- Minor Bug Fixing

Version 2.0.0 Date : 22-11-2019

- Resolved the Issue of GST while creating order from backend

Version 1.0.9 Date : 10-10-2019

- Compatible with Magento 2.3.3 Latest Magento version

Version 1.0.8 Date : 15-07-2019

- Added New Backend Productwide GST Report functionality

- PDF Signature design issue for multiple products is now solved

- You can Export GST Report data & import that data directly in Tally

Version 1.0.7 Date : 26-04-2019

- Now you can import product specific GST just by uploading CSV

- GST Report Grid Update - Added shipping amount to Backend grid view

- Minor Bug Fixing

Version 1.0.6 Date : 10-09-2018

- Now it displays including & excluding tax and shipping

Version 1.0.5 Date : 17-08-2018

- Fixed GSTIN issue for Guest Customers

Version 1.0.4 Date : 26-06-2018

- Added backend support for generating GST report for selected dates

Version 1.0.3 Date : 05-01-2018

- Added Buyer GST Number in Create Account Page and Customer Edit Page

- Compatibility with Magento 2.2.1

- Minor Bug Fixing

Version 1.0.2 Date : 11-12-2017

- Added state code in PDF

- Added Telangana state in business origin

- Added tax rate slab of 3%

- Solved PDF Signature position issue while more than 2 products are there in a single order

- Changed display sequence of GST and Shipping GST applied on order in invoice and credit memo

Version 1.0.1 Date : 13-10-2017

- Now enable GST on Shipping charges as well

- Added CIN Number to include in various order documents

- Added field of PAN number to show in invoice PDF

- Option to add digital signature image and text

- Solved issue related to currency symbol(₹) in invoice PDF

- Formatting changes in order, invoice, credit memo grids and Emails