Magento 2 Multi Vendor Indian GST Extension

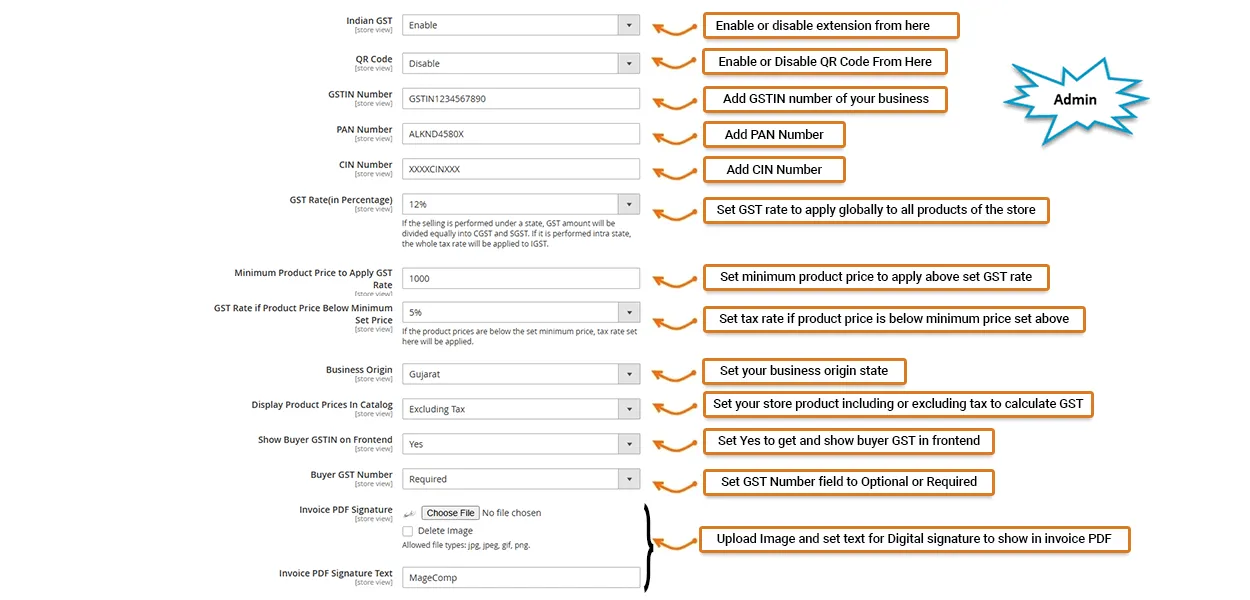

Magento 2 Multi Vendor Indian GST extension helps calculate GST rates and rules to make your marketplace GST-ready based on the seller's business type.

- Enable GST for global, category-specific and product-specific.

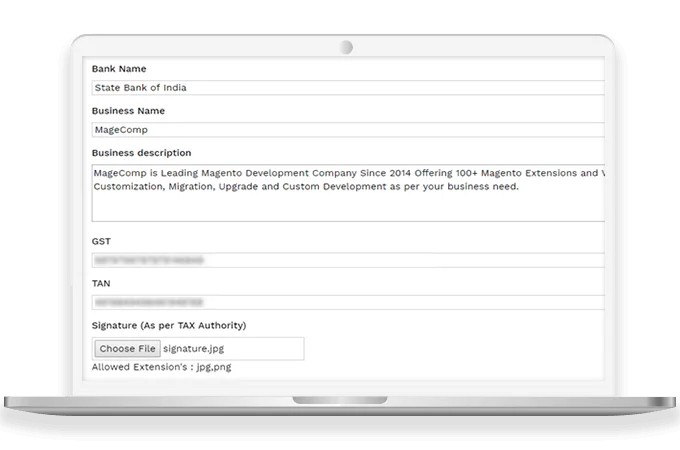

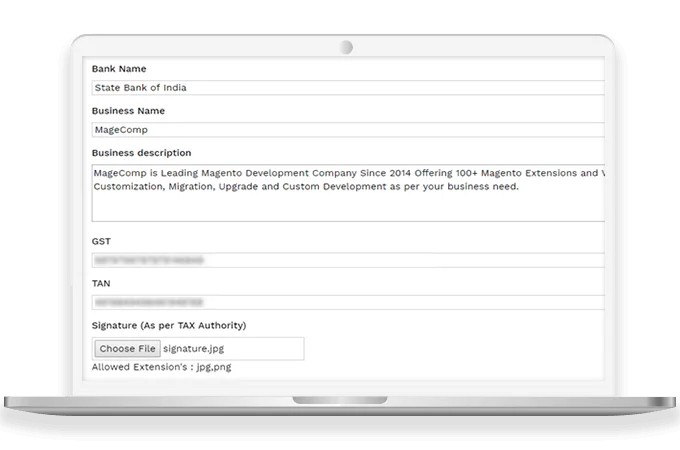

- Specify GSTIN, CIN & PAN number to show in Magento order details.

- Set GST rate for multiple products by uploading CSV file.

- Set product prices as including or excluding GST tax rates.

- Generate Order specific as well as Product-specific GST report as per need.

30 DAY

MONEY BACK

1 YEAR

FREE UPGRADE

1 YEAR

FREE SUPPORT

With an aim to create one tax that can replace all existing multiple taxes levied by the Indian central and state governments, Goods and Services Tax (GST) was introduced by the government itself and came into effect from July 1, 2017. Basically, GST is an indirect tax, multistage, destination-based tax that is calculated on the supply of goods and services. It means all the E-commerce stores are covered under the hood of GST and Magento stores are no longer the exception in such case as it is compulsory for all Indian store owners to implement the GST. Even the World Bank says that GST is among the most complex system in the world.

Because the whole tax is divided into different tax slabs, it’s not easy to implement such a complex system in Magento 2. Things are different when you have a multi-vendor marketplace, as there are multiple vendors who come across and sell their products in your marketplace. At that time, you have to calculate the GST tax rate depending on the product and its category type as there are different tax slabs and it’s not easy as you think. Cause one Vendor sells multiple types of products in your store. To simplify things you need a whole automation system that collect tax rates from your vendors and calculates accordingly.

Magento 2 Multi-vendor Indian GST Extension AKA Magento Multi-vendor GST Module by MageComp auto-calculates GST on marketplace products as per configured by the vendor and add it on goods and services sold by your Magento stores. The module will automate the whole GST calculation process and it is aligned to the Indian government's GST standards. Also, the extension displays the vendor's GST number and summary in all Magento order documents like invoice, shipments, and credit memos.

Benefits of Magento 2 Multi Vendor Indian GST Extension

Add GST Rate to Store Products

Different products have different GST rates. So with the help of the Magento 2 Multi-vendor GST Module, the vendors can attach GST rates for all their products.

Calculate Tax for Multiple Products from Multi Vendors

The cart may contain products from different vendors. Magento 2 Multi-vendor Indian GST Extension offers counting GST for all the products automatically and display in the order subtotal.

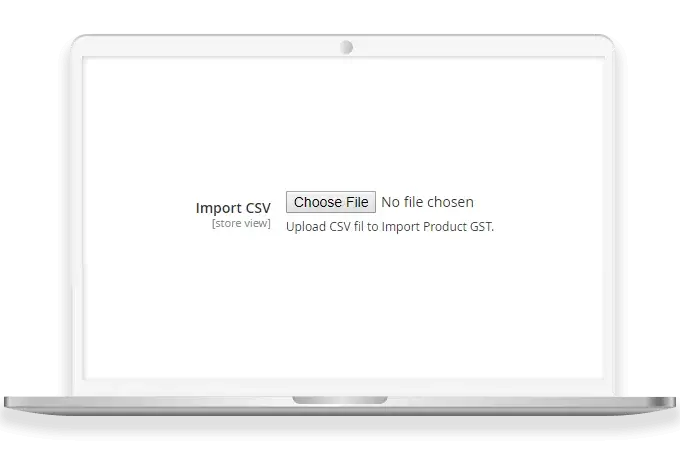

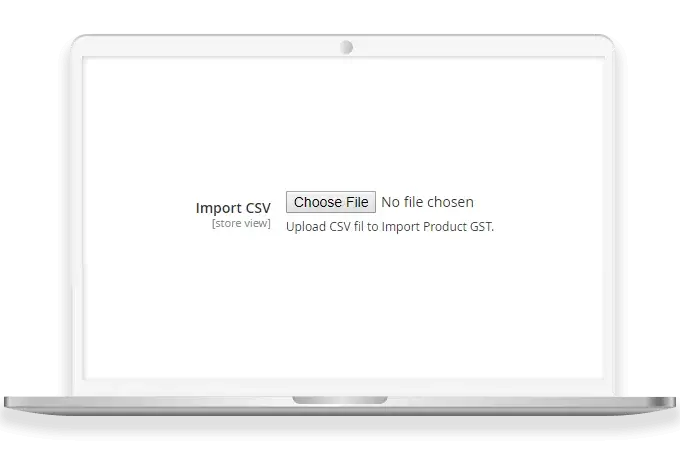

CSV File for Calculating GST Rates for Multiple Products

Different vendors sell different products. So maintaining GST rates of all the products becomes difficult. Thus, this module allows the store admin to maintain GST rates of various products with the help of a CSV file.

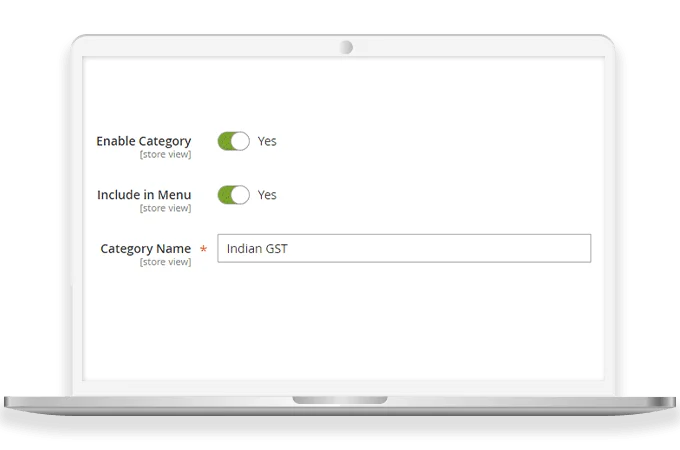

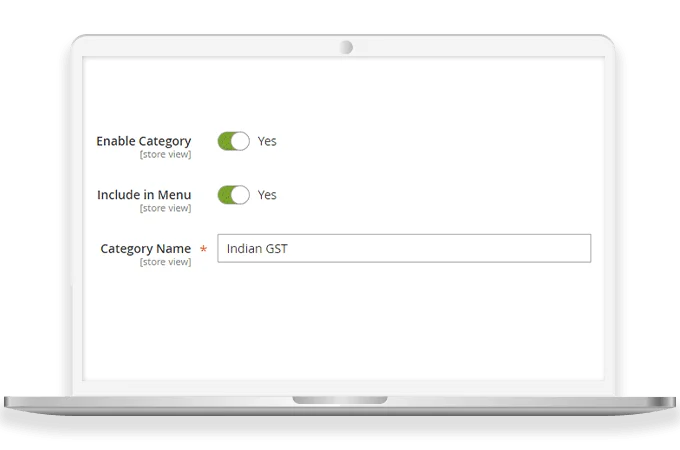

Apply GST to Spicific Products or Categories

GST value for all the products may vary. Hence, this extension can be of use while implementing global, category-specific, and product-specific GST.

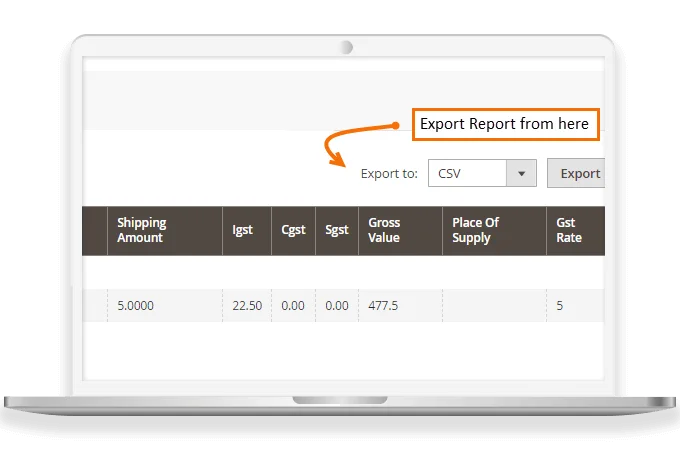

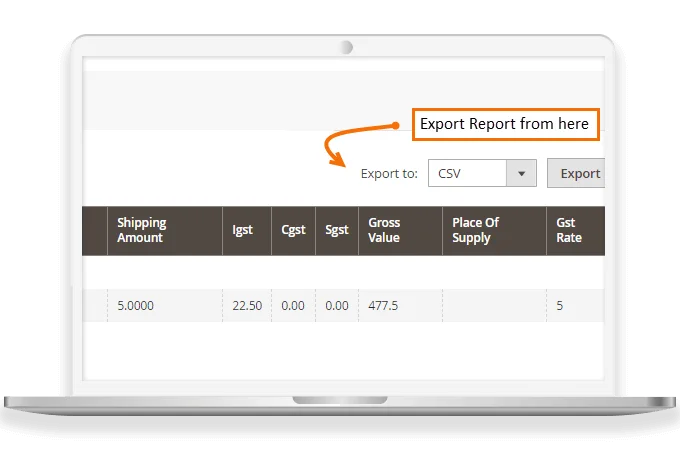

Order-specific & Product-specific GST Reports Generation

It automatically calculates the GST rates of the products and displays the detailed bifurcation of the tax rates.

GSTIN, CIN & PAN Number in Invoice

Magento 2 Multi-vendor Indian GST Module helps to show GSTIN, CIN, and PAN number in the order details.

Product Prices as Including or Excluding GST Rates

The product prices specify whether the GST rates are including or excluding the displayed price. The including prices also indicates the division of taxes charged.

Version 1.0.1 Date : 26-05-2025

- Compatible with Magento 2.4.8 version

- Minor bug fixing