Hello Magento Folks ?,

How are you all? Welcome back to Magento 2 Tutorial Blog series. Today’s article is How to Configure/Setup Value Added Tax (VAT) in Magento 2. Do not miss our prior published tutorial blog, How to Configure/Setup Return-Path Email in Magento 2. Let’s get started ?

Introduction:

Value Added Tax (VAT) is the tax rate charged on different goods based on the manufacturing or distribution of products, materials, or services that the store is selling. It is calculated on the basis of the percentage on the selling price of the products. You can configure/setup VAT in your Magento 2 store from the admin panel. It also allows adding more than one VAT rate to calculate the tax.

Method to Setup/Configure Value Added Tax:

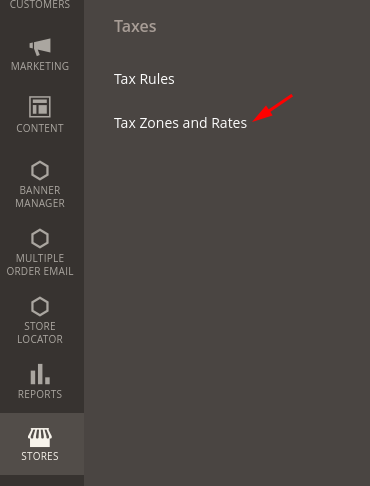

Step 1: Firstly we need to Compose the Customer Tax Classes, Goto Stores>Taxes > Tax Zones and click on Rates.

Make sure it has a Retail Customer tax. If not, create one by clicking on Add New.

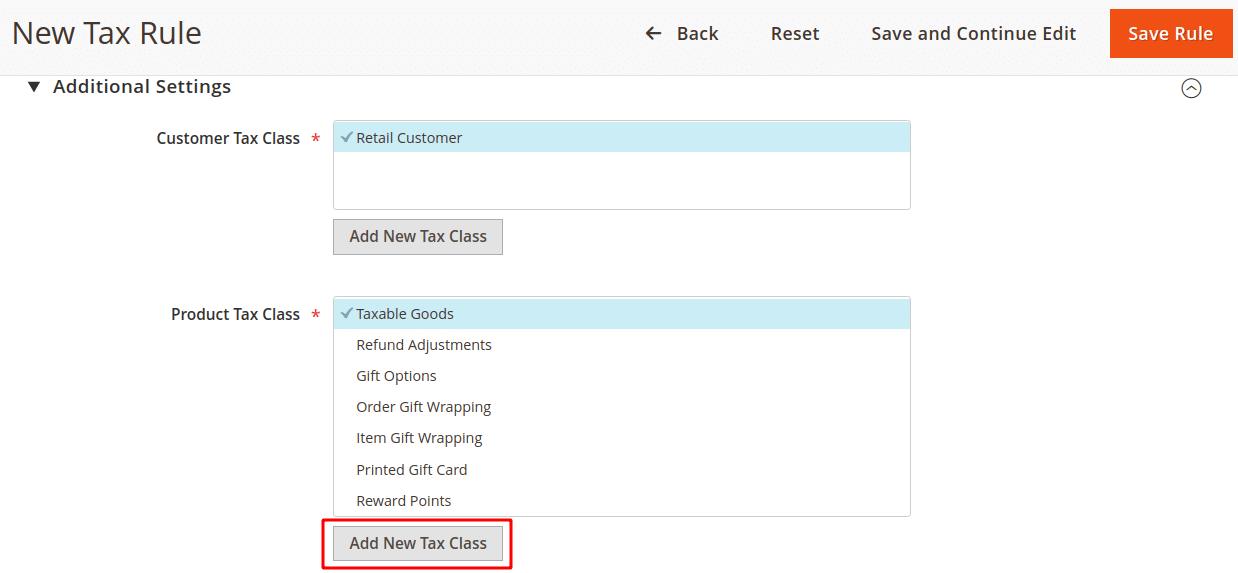

Step 2: Compose Product Tax Classes

- Log in to the Admin Account from the store backend.

- Goto Stores > Taxes > Tax Rules.

- Now tap to Add New Tax Rule section.

- Extend the Additional Settings tab.

- Under the Product Tax Class section, Tap on the Add New Tax Class option.

- Add the following three classes to the Product Tax Class list by clicking the tick mark symbol each time you add new

- VAT Standard

- VAT Reduced

- VAT Zero

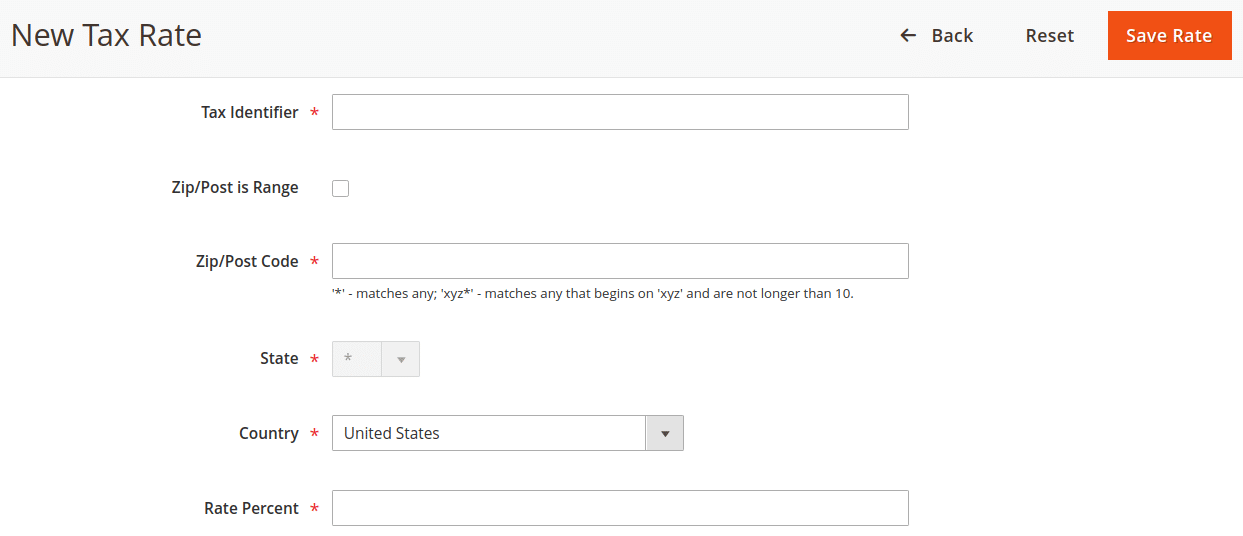

Step 3: Compose Tax Zones and Rates

- Log in to the Admin Account from the store backend.

- Goto Stores > Taxes > Tax Zones and click on Rates.

- Click the Add New Tax Rate and enter the necessary information.

- At last, click Save Rate.

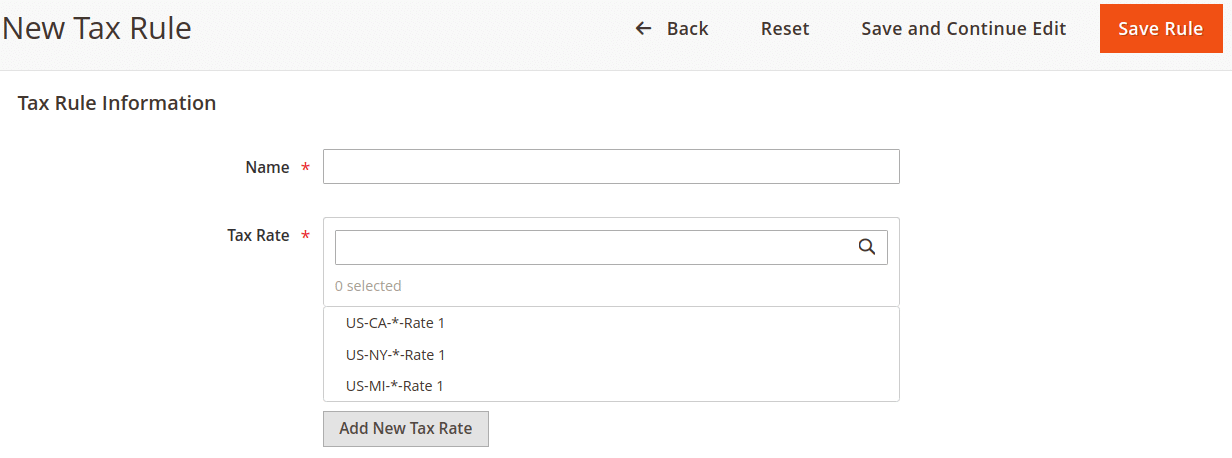

Step 4: Compose Tax Rules

- Log in to the Admin Account from the store backend.

- Goto Stores > Taxes > Tax Zones and click on Rates.

- Click the Add New Tax Rule and enter the necessary information.

- At last, click Save Rule.

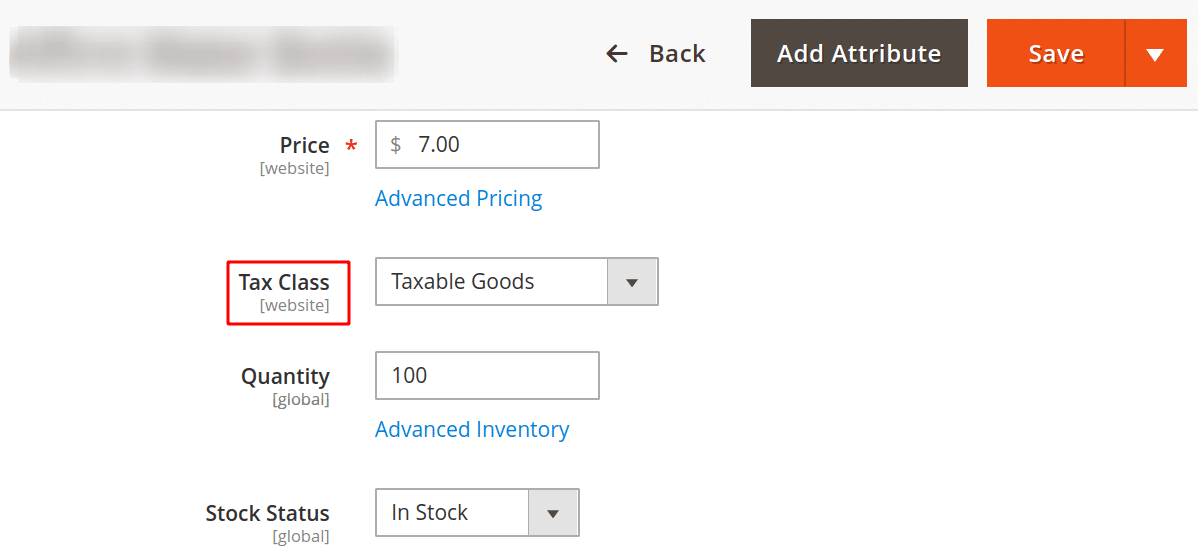

Step 5: Implement tax classes to products

- Log in to the Admin Account from the store backend.

- Navigate to Catalog > Products.

- Select the product for which you want to apply tax rules.

- Move to the Tax Class field and select the appropriate Tax Class from the list you want to apply for that product.

- Click Save.

Concluding Words:

Hence, in this way, you can effectively Configure/Setup Value Added Tax (VAT) in Magento 2. You can also Create Tax Rules Programmatically in Magento 2. To automatically calculate tax for the products and add the tax rates in the product total, Magento 2 Indian GST is favorable for your store.

If you face any constraints while configuring, feel free to ask me in the comment section below. Share the article with your friends. Stay Tuned for the latest updates and solutions.

Happy Configuring ?