Hello Shopify Friends,

I will explain How to Charge Sales Tax on Shopify in this blog.

Sales tax is the tax added to the products and services. Shopify provides built-in tools and features to help merchants calculate and collect the appropriate sales tax based on the store’s location and the customer’s shipping address. Shopify allows merchants to set up tax regions and rates based on the countries, states, or ZIP/postal codes where they are required to charge sales tax.

Let’s learn How to Set up taxes on Shopify and other Shopify sales tax settings.

Steps to Charge Sales Tax on Shopify:

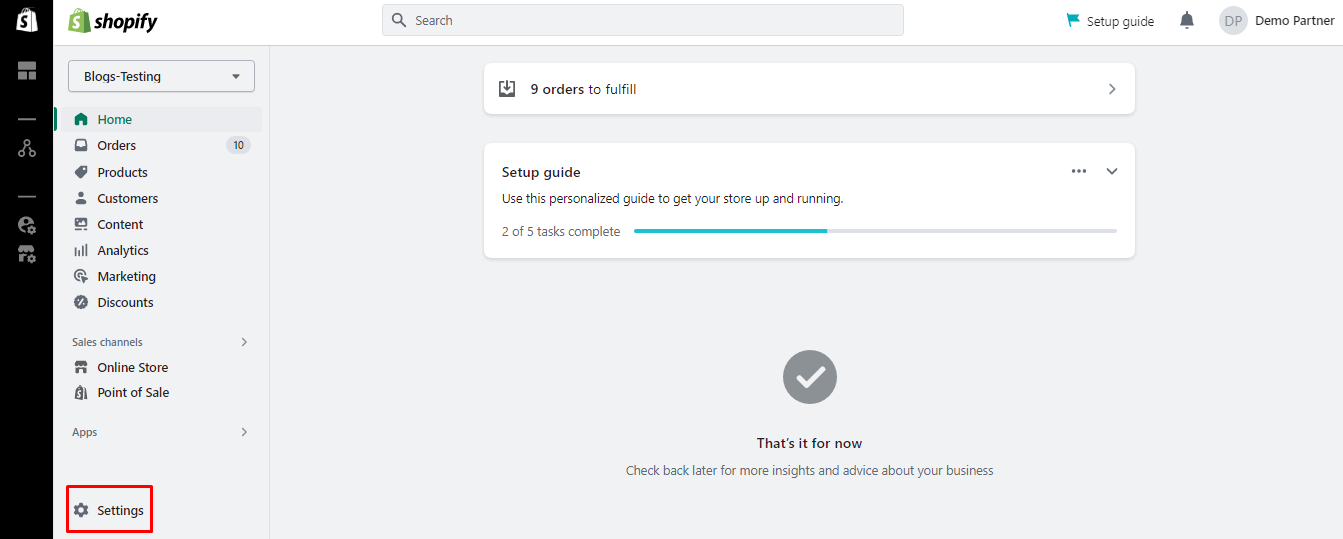

Step 1: Log in to your Shopify Admin Account.

Step 2: From the left menu sidebar, select Settings.

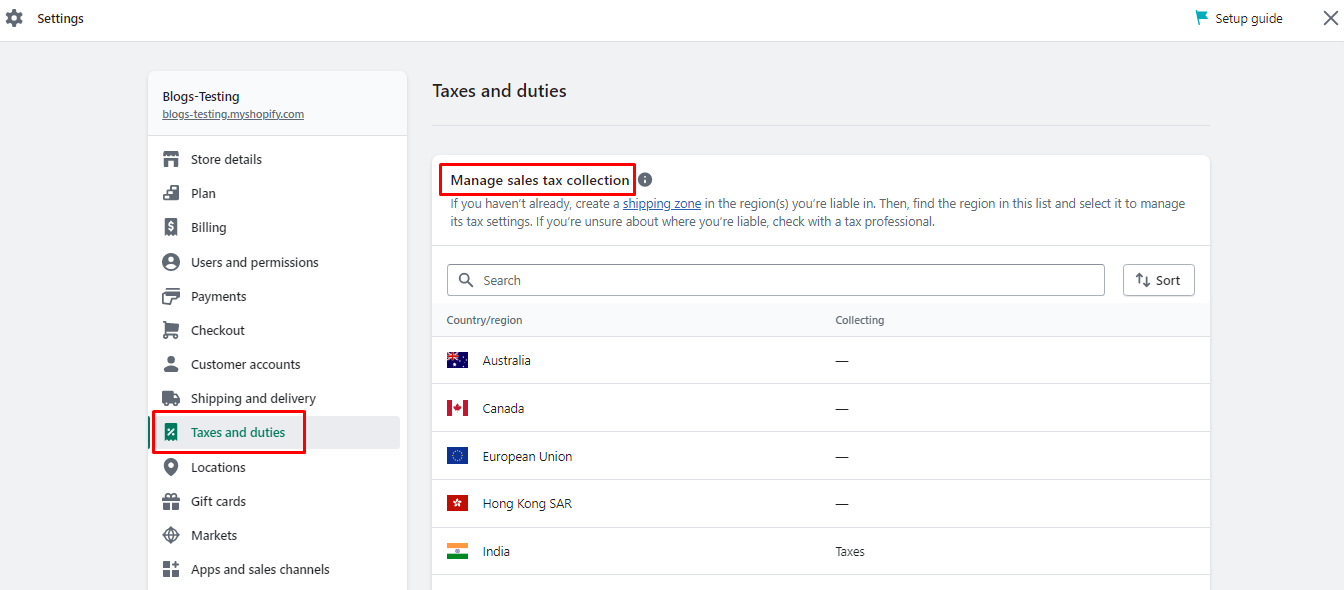

Step 3: Now choose the Taxes and duties option. From the Manage sales tax collection section, choose the country for which you want to set up taxes on Shopify.

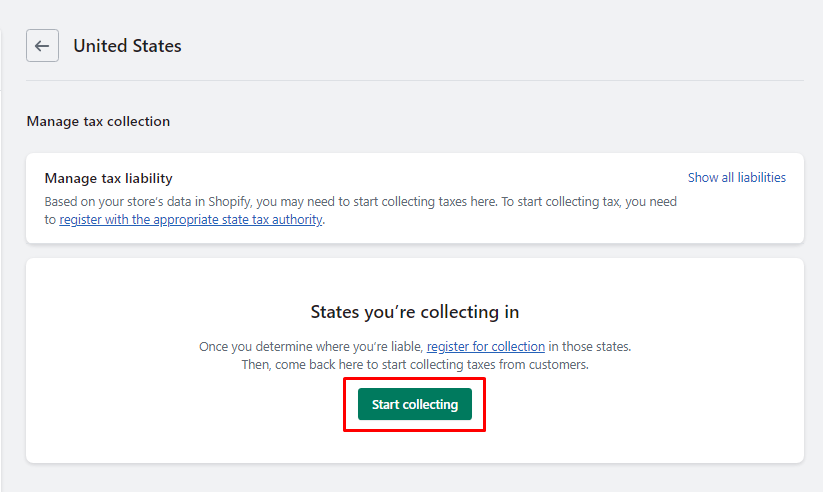

Step 4: Click on Start collecting to collect taxes in Shopify.

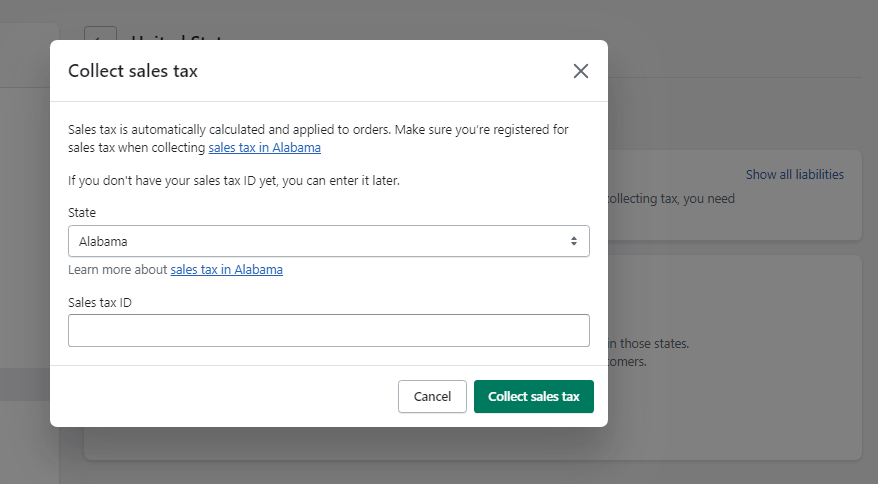

Step 5: Select State from the drop-down and enter your Sales tax ID. Then click on the Collect sales tax button. Add as many states as required by repeating the same process.

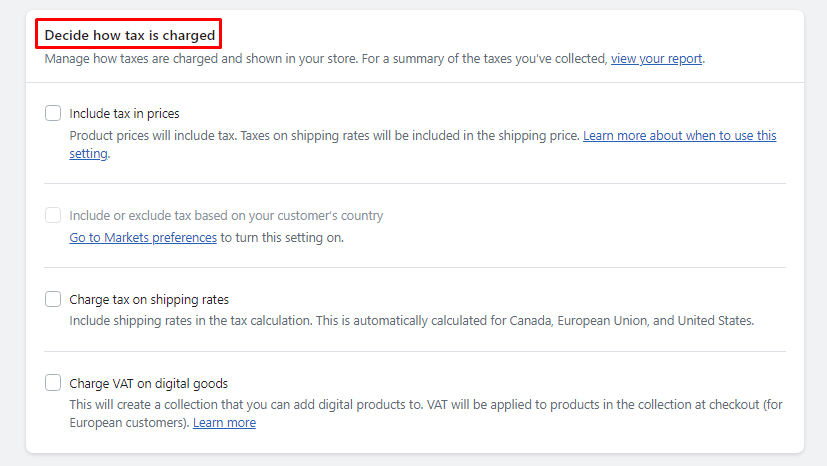

Step 6: Now, come back to the Taxes and duties page. Scroll down to find out the Decide how tax is charged section. You will be provided with 4 options. Choose the appropriate options.

- Include tax in prices

- Include or exclude tax based on your customer’s country

- Charge tax on shipping rates

- Charge VAT on digital goods

Finally, click Save to complete setting up taxes on Shopify.

Concluding Words:

In summary, Shopify allows setting up taxes on Shopify using the Shopify duties and taxes option from the admin panel. If you are unable to apply Shopify sales tax options appropriately, you can Hire Shopify Developer who will help you set up taxes and duties in Shopify.

Share this blog on Shopify collect taxes with your friends and stay tuned with us for more.

Happy Reading!

—————————————————————————————————————————————–

Frequently Asked Questions

(1) What is Shopify?

Answer: Shopify is an e-commerce platform that allows businesses to create and manage online stores. It provides various tools and features to help entrepreneurs sell products or services online.

(2) Do I need to charge sales tax on Shopify?

Answer: Whether or not you need to charge sales tax on Shopify depends on your location and the tax regulations in your jurisdiction. In many countries and regions, businesses are required to charge and collect sales tax on taxable goods and services. It is essential to familiarize yourself with the tax laws that apply to your business and consult with a tax professional if needed.

(3) How do I determine if I need to charge sales tax on Shopify?

Answer: To determine if you need to charge sales tax on Shopify, you should consider the following factors:

- Nexus: Nexus refers to a sufficient connection or presence in a specific jurisdiction that requires you to collect sales tax. Nexus can be established through various factors, such as having a physical location, employees, or inventory in a particular state or country.

- Taxable Goods/Services: Different jurisdictions may have different rules regarding what types of goods or services are subject to sales tax. Research the tax laws in your jurisdiction to understand which products or services are taxable.

- Thresholds: Some jurisdictions may have thresholds that determine when you need to start collecting sales tax. These thresholds are often based on sales revenue or the number of transactions in a specific jurisdiction.

(4) How do I set up sales tax on Shopify?

Answer: To set up sales tax on Shopify, follow these general steps:

- Determine your tax obligations: Research and understand the tax laws that apply to your business based on your location and the jurisdictions where you have nexus.

- Configure tax settings in Shopify: Log in to your Shopify admin panel, go to “Settings,” and then click on “Taxes.” Enable automatic tax calculation if available in your country. Otherwise, you can manually enter the tax rates for the regions where you need to charge sales tax.

- Add tax rates: In the “Taxes” settings, you can add tax rates for specific regions or countries. Enter the applicable tax rates and configure any exemptions or special rules as required.

- Test and verify: After setting up your tax rates, perform test transactions to ensure that the correct taxes are being applied to your products or services.

(5) Can Shopify automatically calculate sales tax?

Answer: Yes, Shopify has built-in functionality that can automatically calculate sales tax for you. However, this feature may not be available in all countries or regions. If automatic tax calculation is supported in your jurisdiction, you can enable it in your Shopify settings. It is recommended to regularly review and update your tax settings to ensure accuracy.