Hello Shopify Friends,

In the current blog, I will explain How to Update your Tax Details on Shopify.

Updating tax details on Shopify is necessary to ensure accurate and compliant tax calculations for your online business. You can perform the Shopify tax settings update process from the admin panel.

Steps to Update your Tax Details on Shopify:

Step 1: Log in to your Shopify Account using your credentials.

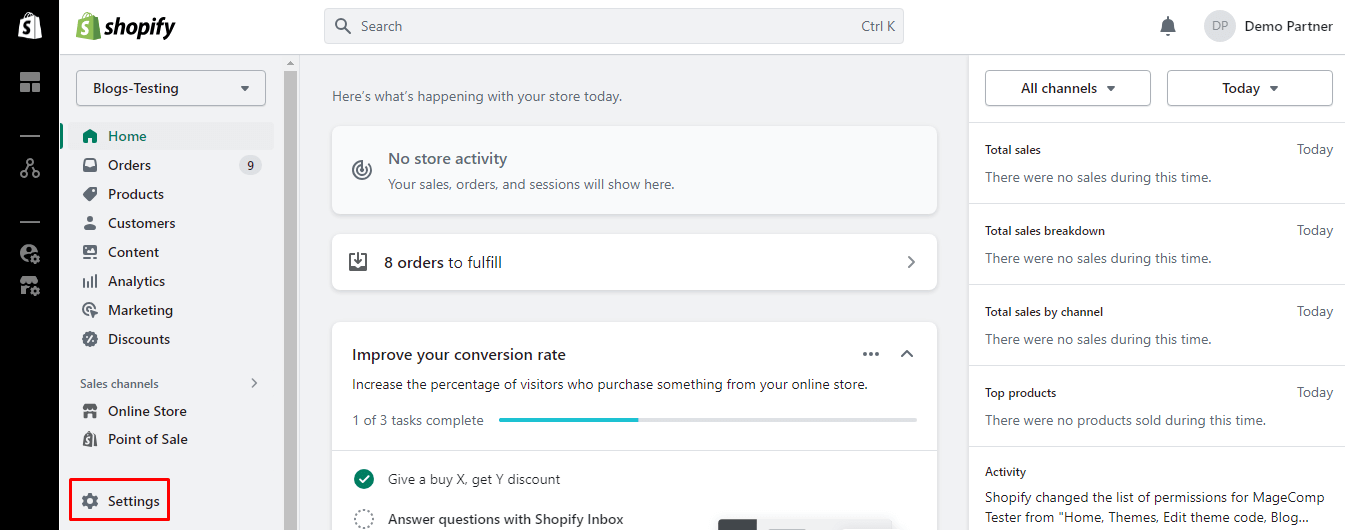

Step 2: Click on the Settings tab located on the lower-left side of the admin panel.

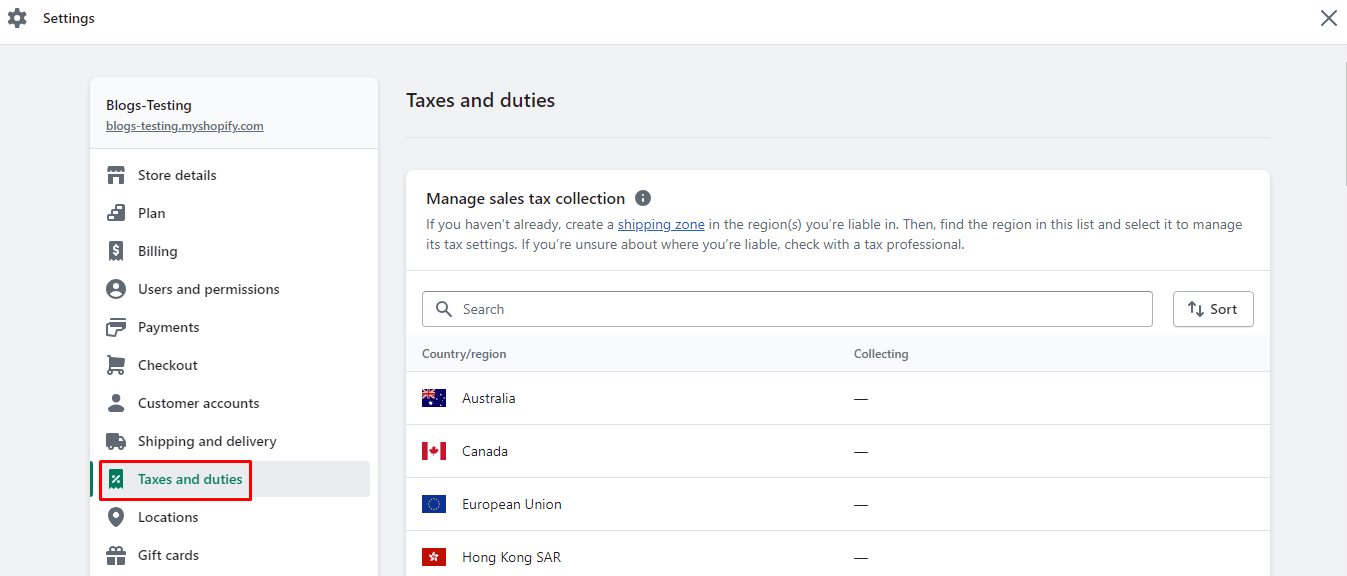

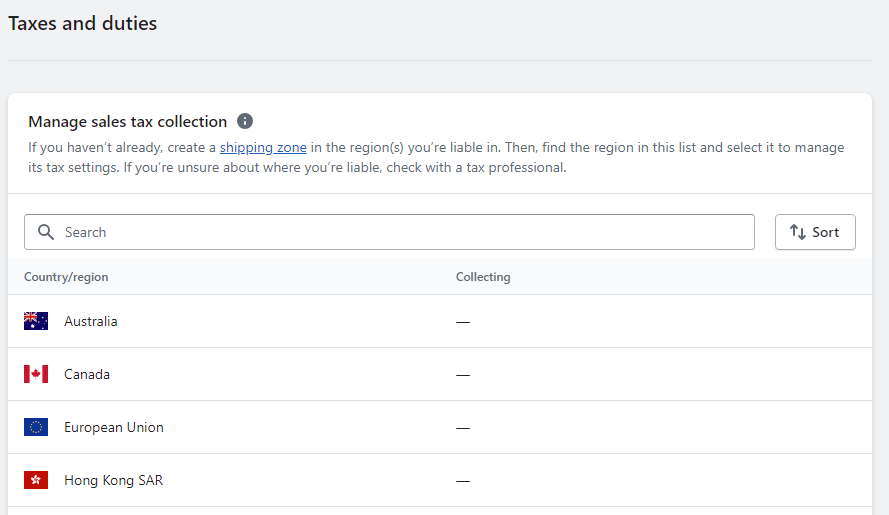

Step 3: Look for the Taxes and duties option and click on it to proceed to update tax information and update tax details.

Step 4: In the Manage sales tax collection section, select the region for which you want to update tax details.

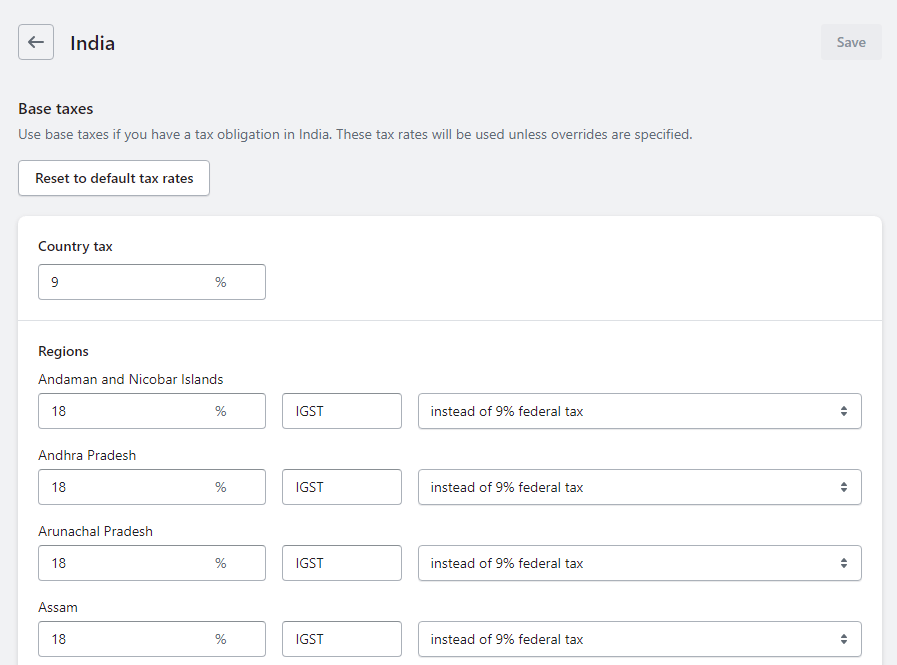

Step 5: Here, you can update tax rates on Shopify.

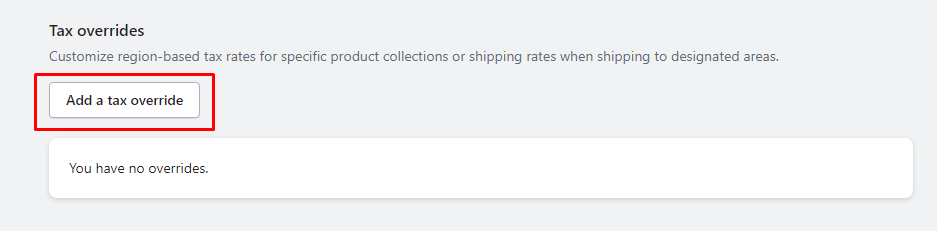

Step 6: Scroll down to add tax override. For that, click on Add a tax override button in the Tax overrides section.

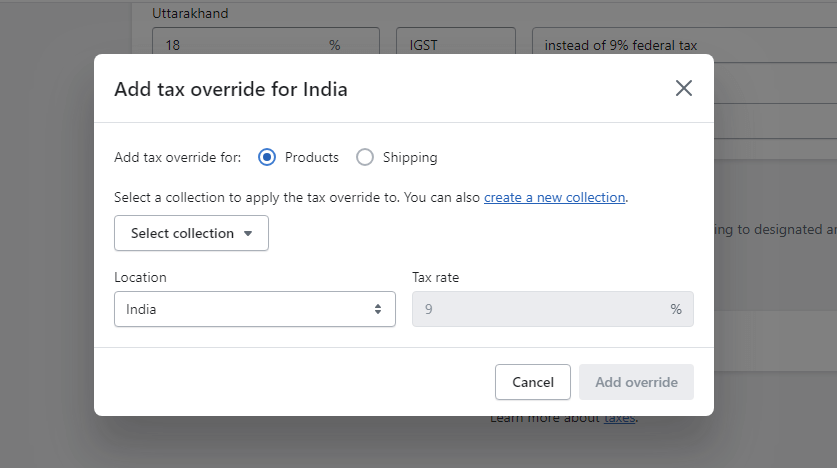

Step 7: Select the Products option to add tax override, select Collection to apply tax override, set Location for tax override, and add Tax rate for tax override. Then click on the Add override button.

Final Words:

This way, you can update tax details on Shopify. If you are stuck anywhere, contact an Experienced Shopify Developer for Shopify tax updates. Share the tutorial with your friends and stay in touch with us.

Happy Reading!

—————————————————————————————————————————————–

Frequently Asked Questions

(1) Why do I need to update my tax details on Shopify?

Answer: Updating your tax details on Shopify is essential to ensure accurate tax calculations and compliance with local tax laws. It helps you charge the correct amount of tax to your customers and facilitates the proper reporting and remittance of taxes to the relevant tax authorities.

(2) How can I update my tax details on Shopify?

Answer: To update your tax details on Shopify, follow these steps:

- Log in to your Shopify admin panel.

- Click on “Settings” and select “Taxes” from the dropdown menu.

- Under the “Tax regions” section, click on the region you want to update tax details for.

- Edit the tax rates or rules as per your requirements.

- Save the changes.

(3) Can I update tax details for multiple regions on Shopify?

Answer: Yes, you can update tax details for multiple regions on Shopify. Follow the steps mentioned above for each region you want to update.

(4) What tax details can I update on Shopify?

Answer: On Shopify, you can update various tax details, including tax rates, tax exemptions, and tax rules. Depending on your region’s tax requirements, you can specify different tax rates for different products, set up tax exemptions for specific customers or product categories, and configure tax rules based on factors like location, product type, or customer group.

(5) How do I determine the tax rates for my products on Shopify?

Answer: The tax rates for your products on Shopify depend on the applicable tax laws in your region. You can consult with a tax professional or refer to the tax authorities’ guidelines to determine the correct tax rates for your products. Shopify also provides automated tax calculation services in some countries, which can help you accurately calculate taxes based on your product and customer location.

(6) Can I integrate third-party tax apps or services with Shopify?

Answer: Yes, Shopify allows integration with various third-party tax apps and services. These apps can provide additional features and functionalities related to tax management, including tax automation, compliance reporting, and multi-channel tax synchronization. You can explore the Shopify App Store to find tax apps that are compatible with your region and business needs.

(7) Do I need to update my tax details regularly on Shopify?

Answer: It’s important to review and update your tax details on Shopify whenever there are changes in tax laws, rates, or regulations in your region. Additionally, if you expand your business to new regions or start selling new types of products, you may need to update your tax settings accordingly. Regularly reviewing and updating your tax details will help ensure accurate tax calculations and compliance.

(8) Can Shopify provide legal or tax advice?

Answer: No, Shopify cannot provide legal or tax advice. While Shopify provides tools and features to manage taxes, it’s important to consult with a tax professional or seek guidance from the relevant tax authorities to ensure compliance with tax laws and regulations specific to your business and region.