The success of your online store hinges on one vital choice: your payment gateway.

After all, you need a way to collect customer payments, right? Otherwise, there’s no money coming in the door. And all of your hard work to get your store up and running is all for nothing.

So, think of a payment gateway as the unsung hero that can elevate a simple purchase and create a delightful experience for your customers.

Plus, in a landscape where younger generations prefer digital wallets and express checkout options over credit cards, finding that perfect payment partner has become an art and a science.

In this article, we’ll cut through the technical jargon and focus on what truly matters: reliability, user experience, and security. We’ll help you find the payment gateway that ticks all the boxes without breaking the bank.

Let’s dive in.

What is a Payment Gateway?

A payment gateway securely transfers the payment information from your customer’s bank to yours, ensuring that the money exchanges virtual hands without a hitch.

But it’s more than just an intermediary. It plays a crucial role in creating a seamless checkout experience.

Think of it as the bridge that connects your customer’s desire to purchase with your ability to fulfill that desire.

So, while it might seem like just another added expense for your online store, it’s the silent champion of every sale — especially when one of the leading causes of cart abandonment is a long, complicated checkout process.

Payment Gateway vs. Payment Processor

It’s crucial to differentiate between gateways and processors. A gateway is the customer-facing interface that collects payment details online, while the processor is the backend system that moves the transaction through the payment network.

The main differences between gateways and processors include:

Role in the Transaction

- Payment gateway: Authorizes and encrypts the payment information from the customer for your online transactions.

- Payment processors: Completes the transaction by moving the funds from the customer’s account to your merchant account.

Level of Customer Interaction

- Payment gateway: Your customer engages directly with it on your checkout page.

- Payment processors: They operate behind the scenes and have no direct interaction with the customer.

Type of Security Measures

- Payment gateways: Secure your customer’s data by encrypting the payment information before it moves to the processor.

- Payment processors: Facilitate the secure transfer of funds and information between the bank and your account.

How to Select the Best Payment Gateway

Are you ready to select the best payment gateway for your ecommerce store? Follow these tips and tricks to simplify the process.

Evaluate Your Business Needs

If your business has a global reach or plans to expand internationally, consider a gateway that supports multiple currencies and understands international compliance standards.

Paying attention to the small details enhances the customer experience with localized payment options and streamlines your operations. That way, you can avoid the complexities of dealing with various currencies and regulations.

The key is to choose a payment gateway that meets your current operational requirements and has the scalability and flexibility to adapt to your business’s future growth.

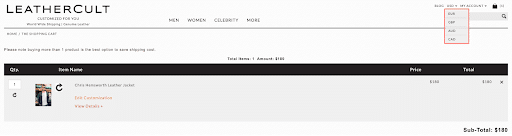

Take, for instance, LeatherCult, a premium brand specializing in custom leather jackets. They’ve strategically chosen to integrate PayPal as their primary payment gateway.

This decision has proved beneficial, as it caters to a wide international audience, providing customers with a trusted and familiar payment option across currencies.

When you prioritize these aspects in your payment gateway selection, you’re enhancing your online store’s credibility and ensuring a smoother and more inclusive shopping experience for your customers.

The result? Better customer satisfaction, which drives your ecommerce success forward.

Understand Your Audience’s Payment Preferences

Providing a variety of payment options is key to accommodating a diverse customer base.

This flexibility caters to those who value convenience and speed, offering one-click solutions, and those who prioritize security, preferring methods with robust fraud protection.

Some of the most common types of online payments include:

- Digital wallets

- Credit cards

- Debit cards

- Account-to-account (A2A) payments

- Buy now, pay later (BNPL)

- Cash on delivery (CoD)

In 2022, the adoption of digital payments has surged, reaching an impressive 89% penetration.

In fact, McKinsey’s 2022 Digital Payments Consumer Survey shows a significant increase in consumers using multiple digital payment forms, rising from 51% in 2021 to 62%. This growth is particularly noticeable in in-app and peer-to-peer (P2P) transactions, which have expanded rapidly on top of the already prevalent use of online payments.

Why? Customers see a large value proposition from digital wallets, from ease of use to unlocking access to one-time deals.

In short, you can’t go wrong with a payment gateway that prioritizes digital wallets and convenience.

Prioritize Compliance and Security

Make sure your chosen gateway complies with the Payment Card Industry Data Security Standard (PCI DSS).

Compliance with PCI DSS means the payment gateway adheres to stringent security measures to protect cardholder data, such as:

- Managing vulnerabilities through regular updates and patches

- Implementing strong access control measures

- Regularly monitoring and testing networks

- Maintaining an information security policy

- Maintaining a secure network

- Protecting cardholder data

Security features like multi-factor authentication and HTTPS encryption are also must-haves to protect against fraud.

It’s equally crucial to ensure robust data backup services are in place to prevent any loss of essential financial information.

By providing these security layers, retailers offer peace of mind to their customers. After all, in 2026, confidence in secure transactions and data protection may heavily influence where consumers decide to shop online.

Consider the Fees

Be aware of the costs associated with each gateway, such as transaction fees, chargeback fees, and any monthly service fees. These can affect your pricing strategy and profitability.

Transaction Fees

Payment gateways make money by collecting transition fees from every sale. Generally, the fee hovers around 2% to 3% per transaction.

Setup Fees

Most payment gateways have an initial fee for integrating the gateway into your existing ecosystem.

It’s a one-off charge that can reach upwards of $200, depending on how complex your setup is and the customization required to sync the gateway with your existing infrastructure.

Chargeback Fees

In instances where a transaction is disputed, chargeback fees come into play. The bank imposes these fees to cover the administrative costs of handling the disputed funds until the issue is resolved.

Typically, chargeback fees can range from $15 to $35 per incident, but this can escalate for higher-priced products or services due to the increased risk involved.

Being cognizant of these fees will help you make a more informed decision when selecting a payment gateway, ensuring you choose one that aligns with your business’s financial model and transaction volume.

Integration and Compatibility With Your Existing Tech Stack

When selecting a payment gateway for your ecommerce store, it’s crucial to consider how well it integrates with your existing tech stack.

Why? Seamless integration simplifies transactions and enhances the overall efficiency of your business operations.

For instance, if your store is on Shopify, leveraging their built-in payment solution, Shop Pay, could be a strategic move. Shop Pay is designed to work harmoniously with Shopify’s ecosystem, offering a streamlined and user-friendly checkout experience.

It also comes with the added benefits of Shopify’s security and support system, ensuring a secure and smooth transaction process for you and your customers.

Take the example of House of Joppa, an ecommerce store specializing in modern Catholic goods. By integrating Shop Pay into their Shopify platform, they’ve created a seamless shopping experience.

Customers enjoy a quick and easy checkout process for rosaries, while the store benefits from the reliability and security of a native Shopify solution. This integration guarantees that their tech stack works cohesively, increasing customer satisfaction and boosting conversion rates by as much as 50%.

Aligning your payment gateway choice with your existing ecommerce platform can lead to a more cohesive and efficient operation.

It removes the need for complex integrations and leverages the full potential of your chosen ecommerce platform. That way, you can provide your customers with a smoother, more reliable shopping experience.

Pro tip: To further enhance your operations, consider partnering with a reliable courier service to get your products into the hands of your customers faster. It’s the cheery on top of a smooth experience with your brand. The result? Loyal customers that’ll happily return to purchase more items.

Top Ecommerce Payment Gateways for 2026

Now, for the moment you’ve been waiting for, Here are some of the most popular payment gateways for your online store.

1. Stripe

Best for: Simplified PCI compliance and global currency support

Stripe offers a robust cloud-based solution with competitive processing fees and a user-friendly interface, making it a top choice for new and growing businesses.

2. Authorize.net

Best for: Customizable payment solutions

Authorize.net is powered by Visa and is known for its flexibility and comprehensive fraud protection features. It allows businesses to customize their payment processes, aligning them with specific operational workflows.

3. PayPal

Best for: Global reach and ease of use

PayPal remains a dominant player, prized for its wide acceptance and ease of integration. Its fees are straightforward, and it offers the convenience of a payment gateway and processor in one.

4. Verifone (formerly 2Checkout)

Best for: International payment flexibility

Verifone stands out for its global reach and support for various payment methods, catering to businesses with an international customer base.

5. Square

Best for: An integrated payment system

Square is ideal for businesses that want a seamless payment experience without needing a separate gateway. Its comprehensive set of tools helps manage sales effectively.

Wrapping Up

In 2026, the right payment gateway isn’t just a transactional tool but a cornerstone of your ecommerce strategy.

It should align with your business model, offer security and compliance features, and come with a fee structure that makes sense for your financial planning.

With customer expectations continually evolving, selecting a payment gateway that offers both security and convenience will be a deciding factor in the success of your ecommerce store.

Great insights on choosing the right payment gateway! Secure and seamless transactions are crucial for eCommerce success. Thanks for this informative guide!

Really well explained, especially the balance between security, fees, and checkout experience. Payment gateways clearly play a bigger role in conversions than many store owners realize. A solid read for anyone scaling ecommerce in 2026.