Hello Shopify Friends,

This blog explains to you about configuring tax settings in your Shopify store.

Configuring tax settings in your Shopify store ensures compliance with tax laws and provides accurate tax calculations for your customers. Shopify offers a user-friendly interface that allows you to set up tax rates based on your business’s tax nexus and the type of products you sell.

Let’s check out the steps to configure tax settings in your Shopify store.

Steps to Configure Tax Settings in Shopify:

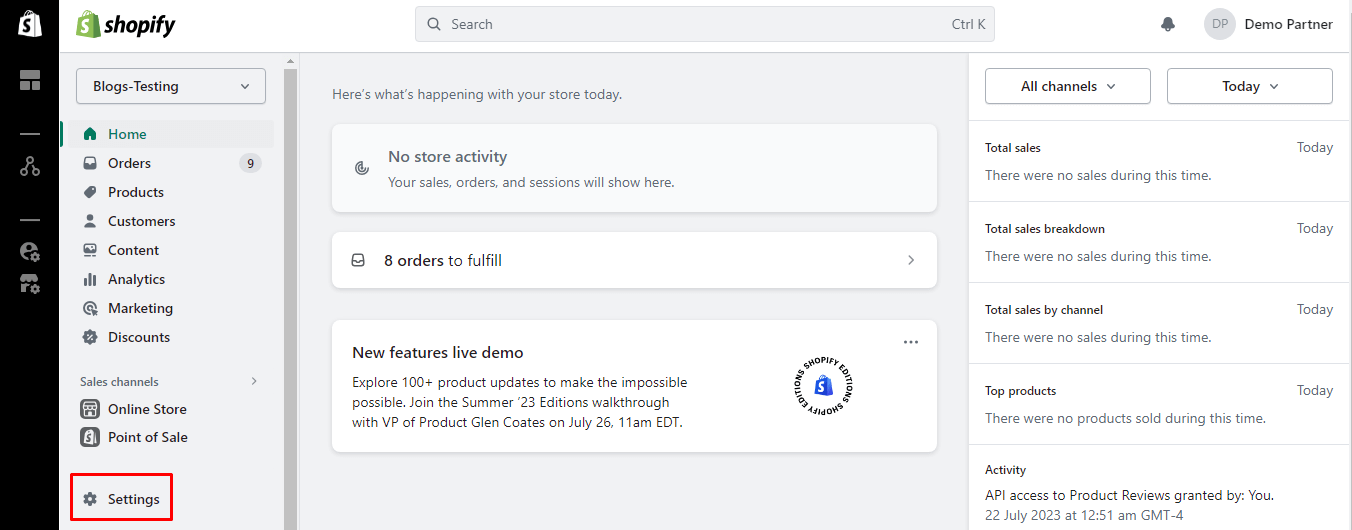

Step 1: Visit Shopify’s website and sign in to your store’s admin panel using your credentials.

Step 2: In your Shopify admin, click on Settings, located in the lower-left corner.

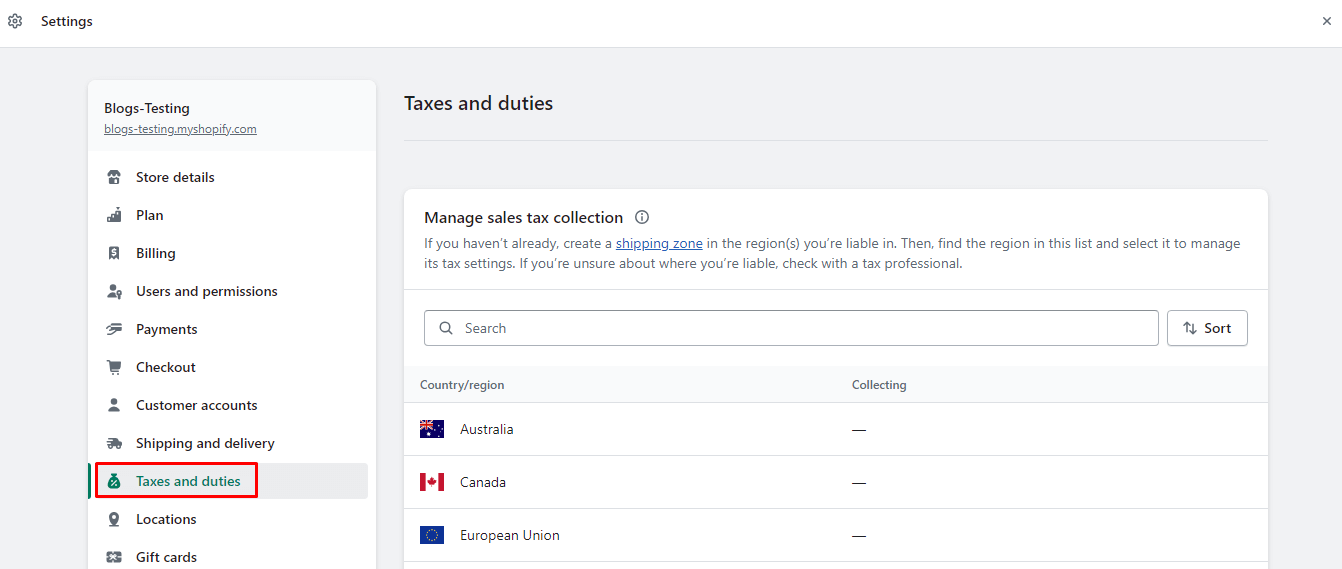

Step 3: Select Taxes and duties from the menu list.

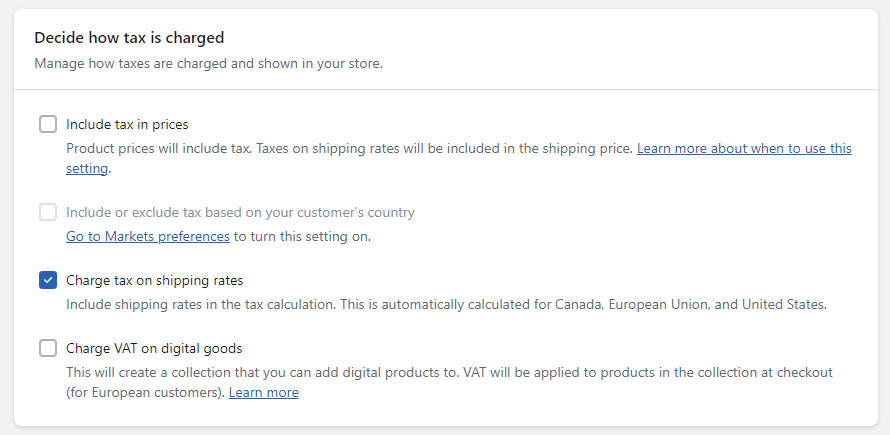

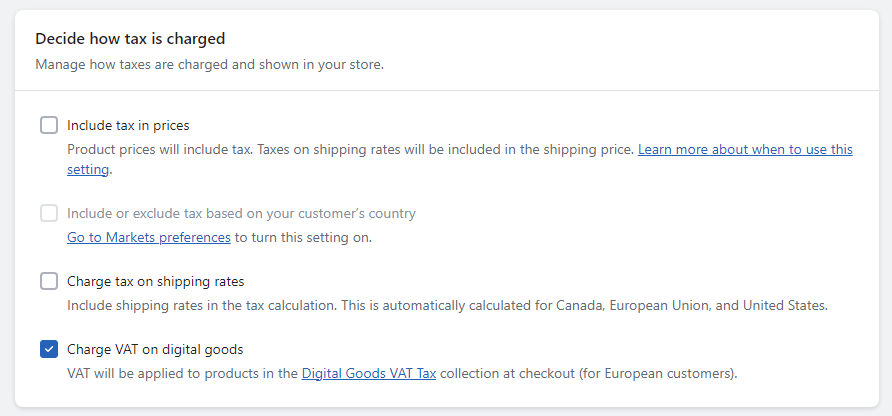

Tax Setup on Shipping Rates

- Choose the Charge tax on shipping rates option.

VAT on Digital Goods

- Choose the Charge VAT on digital goods option.

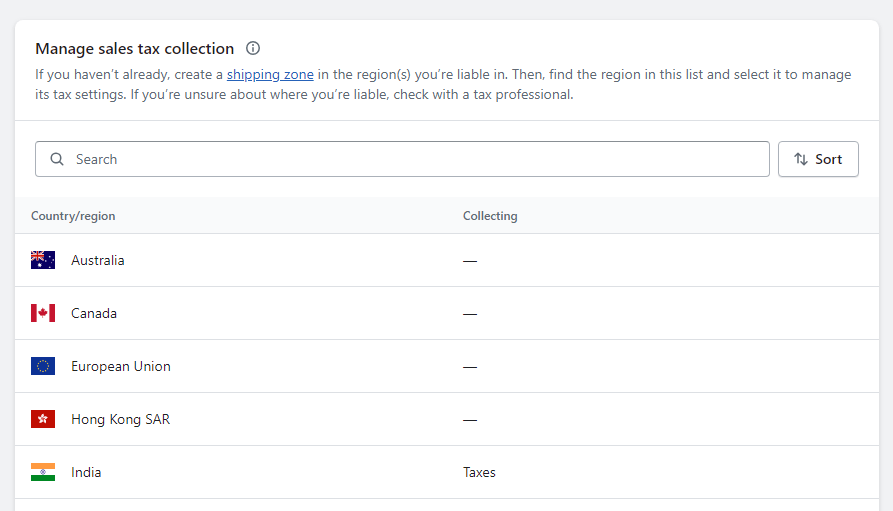

Tax Setup by Country/Region

- Select the country and apply tax settings accordingly in the Manage sales tax collection.

Final Say:

Properly configuring tax settings in your Shopify store is vital for legal compliance and accurate tax calculations. By following the steps outlined in this guide and seeking expert advice when needed, you can ensure that your tax settings are set up correctly and provide a seamless shopping experience for your customers.

Related articles

- How to Update your Tax Details on Shopify?

- How to Charge Sales Tax on Shopify

- How to Report Tax on Shopify?

Happy Reading!