Hello Shopify Friends,

Want to learn about Tax Reporting in Shopify? You are at the right place.

This blog provides an overview of the Shopify tax filing process and How to Get Tax Reporting on Shopify.

What is the Tax Report in Shopify?

In Shopify, a tax report summarizes the tax-related information and calculations for your store’s sales transactions. It provides an overview of the taxes collected from customers and helps you accurately track and report your tax liabilities. Shopify’s tax reports can assist you in understanding and managing your tax obligations.

Shopify Tax Filing Process

The Shopify tax filing process can vary depending on your location and the specific tax regulations that apply to your business. However, here are some general steps to consider when filing taxes on Shopify store:

- Gather financial records: Collect all relevant financial records, including sales data, expense receipts, shipping records, and any other documentation related to your business’s income and expenses.

- Determine your tax obligations: Research and understand the tax obligations specific to your jurisdiction and your business type. Identify the types of taxes you need to file, such as sales tax, value-added tax (VAT), or income tax.

- Review Shopify’s tax reports: Utilize Shopify’s tax reports to gather the necessary data for your tax filings. These reports provide information on sales transactions, tax calculations, and tax collected from customers. Access these reports in the “Analytics” or “Reports” sections of your Shopify admin panel.

- Prepare tax forms: Based on your jurisdiction and tax obligations, determine the specific tax forms required for your tax filing. Common forms include sales, VAT, or income tax returns. Fill out these forms accurately, providing all necessary information.

- Calculate tax liabilities: Use the information from Shopify’s tax reports and your financial records to calculate your tax liabilities. This includes determining the amount of tax collected from customers and any applicable deductions or exemptions.

- File tax forms: Submit your completed tax forms to the relevant tax authority. The filing process can vary depending on your jurisdiction. Some tax authorities allow online filing, while others require physical submission. Follow the instructions provided by your tax authority and ensure you meet the filing deadlines.

- Pay any tax owed: If you have tax liabilities, make the necessary payments as required by your tax authority. Follow the instructions provided for payment methods and deadlines. Keep records of your payment confirmations for future reference.

Steps to Get Tax Reporting on Shopify:

Step 1: Log in to your Shopify Admin Panel.

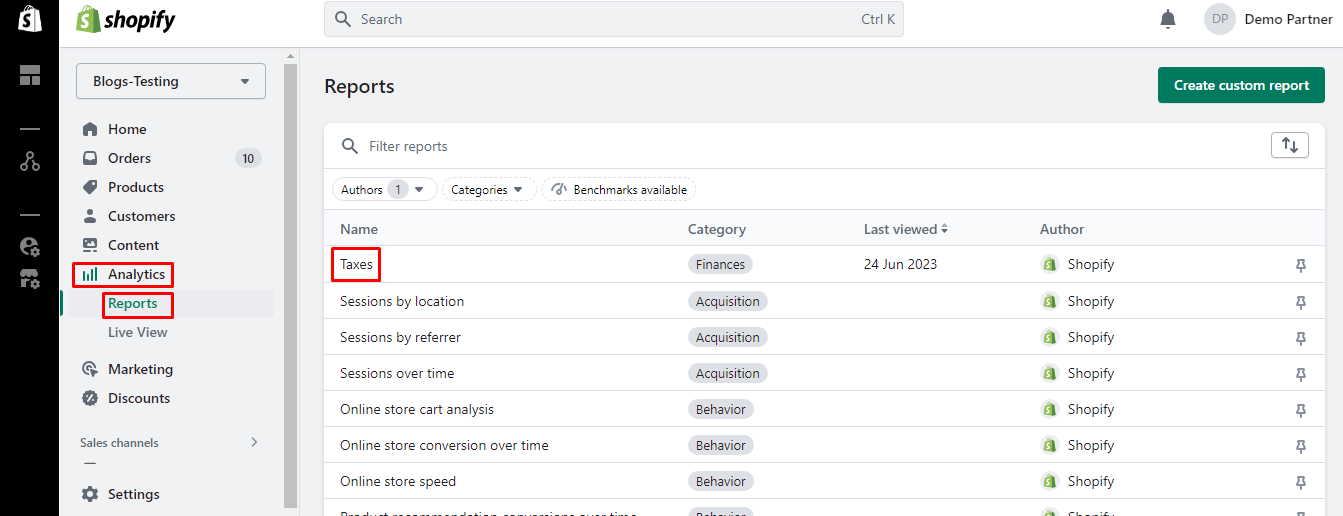

Step 2: From the left menu bar, navigate to Analytics > Reports.

Step 3: In the Finances category, find the report named Taxes.

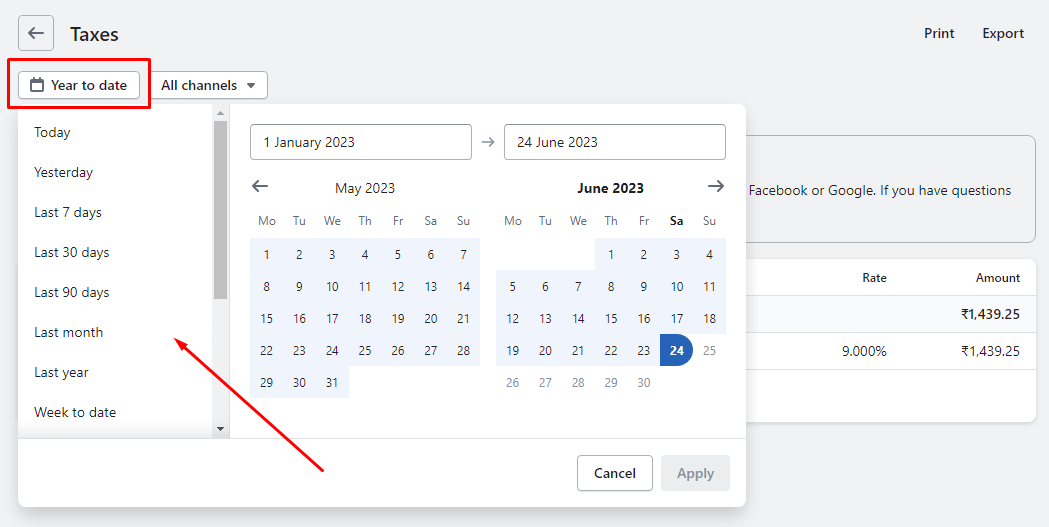

Step 4: Choose the applicable date range to view the tax report on Shopify.

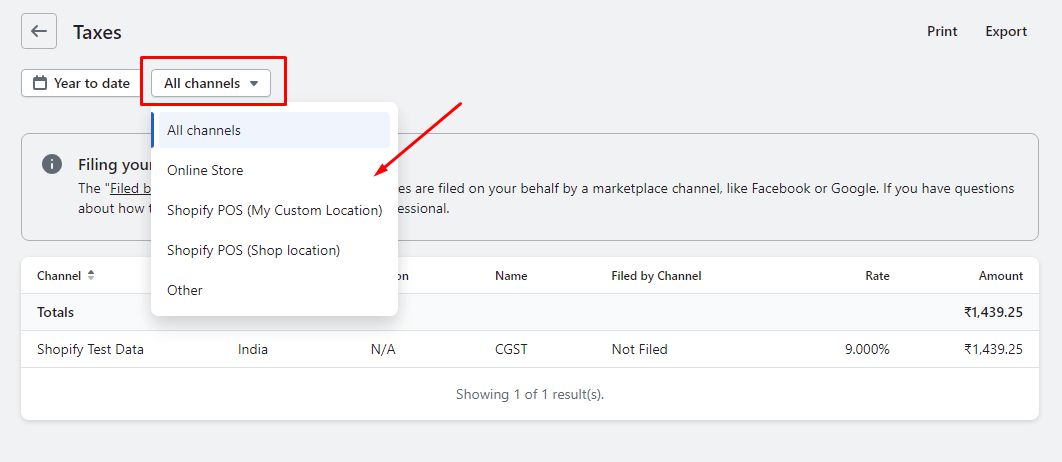

Step 5: You can also get the Shopify tax reporting depending on the channel.

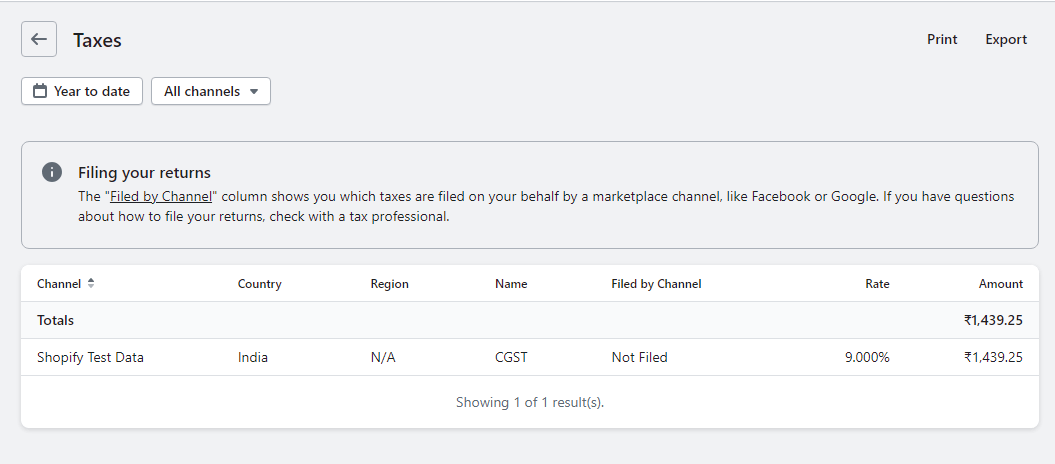

Step 6: The tax report is generated and shows the statistical data of the taxes charged on orders, the region, and the tax rate.

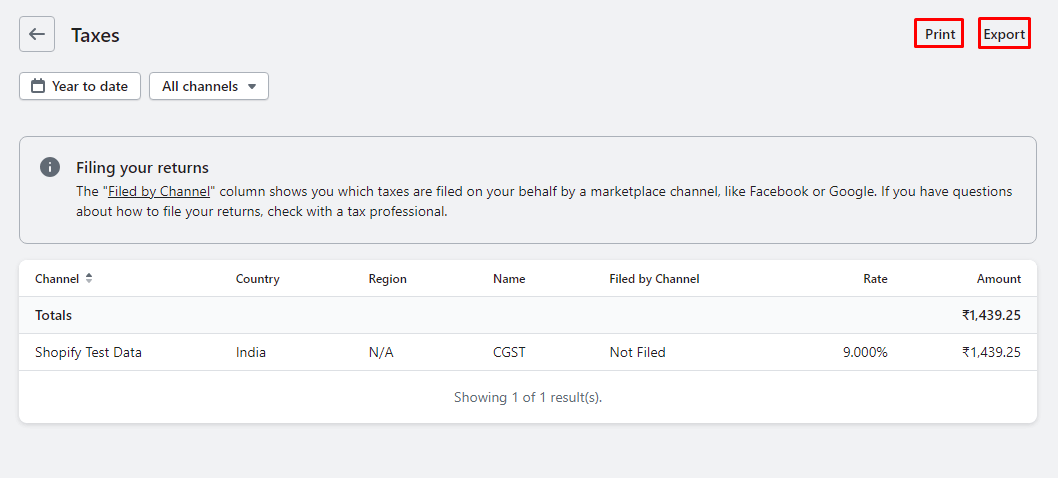

Step 7: You can Export or directly print the Shopify tax report.

Final Say:

The tax filing process can vary depending on your location and specific circumstances. It’s important to familiarize yourself with the tax regulations applicable to your business and consult with professionals to ensure accurate and compliant tax filings.

Happy Reading!

—————————————————————————————————————————————–

Frequently Asked Questions

(1) How do I report taxes on Shopify?

Answer: To report taxes on Shopify, follow these general steps:

- Determine your tax obligations: Understand the tax laws and regulations that apply to your business. This includes identifying which taxes you need to collect based on your location and the location of your customers.

- Configure tax settings: Set up your tax settings in your Shopify admin panel. Navigate to the “Settings” tab and select “Taxes.” Configure your tax rates based on the requirements of your jurisdiction. You can set up automatic tax calculations or manual tax rates.

- Collect tax from customers: Once your tax settings are configured, Shopify will automatically calculate the appropriate taxes on orders based on the customer’s location. Taxes will be added to the order total during checkout.

- Keep detailed records: Maintain accurate records of all tax-related transactions, including sales and tax amounts collected. This information is essential for reporting purposes.

- Generate tax reports: Shopify provides built-in tax reports that can help you summarize and review your tax-related data. These reports can assist you in filing your taxes correctly.

- Consult a tax professional: If you are unsure about your tax obligations or how to report taxes accurately, consider consulting with a tax professional or accountant who can provide guidance specific to your business.

(2) Which taxes do I need to collect on Shopify?

Answer: The taxes you need to collect on Shopify depend on various factors, including your business location and the location of your customers. Common taxes that may apply include sales tax, goods and services tax (GST), value-added tax (VAT), and other local taxes.

It is essential to research and understand the tax laws and regulations that apply to your business. Consult with a tax professional or local tax authority to determine which taxes you need to collect and remit.

(3) How often do I need to report and remit taxes on Shopify?

Answer: The frequency of reporting and remitting taxes on Shopify varies depending on your jurisdiction and tax obligations. In some regions, taxes may need to be reported and remitted monthly, quarterly, or annually.

Consult with a tax professional or your local tax authority to determine the specific reporting and remittance schedule applicable to your business.

(4) Are there any tax exemptions or exceptions on Shopify?

Answer: Tax exemptions and exceptions vary depending on your location and the nature of your business. Some jurisdictions may provide exemptions for specific types of products or services, thresholds for small businesses, or exemptions for certain nonprofit organizations.

Research your local tax laws or consult with a tax professional to identify any exemptions or exceptions that may apply to your business.

(5) Can I integrate third-party tax apps with Shopify?

Answer: Yes, Shopify supports integration with various third-party tax apps that can help you manage tax compliance. These apps offer advanced tax calculation features, automatic filing, and integration with accounting software.

You can explore the Shopify App Store to find tax apps that integrate seamlessly with your Shopify store. Ensure you choose a reputable app with positive reviews and that meets your specific tax requirements.