1st July, 2017 is known as GST day as Indian government introduced “One Nation One Tax” excluding all other taxes with single GST. It is an indirect tax applicable in India replacing multiple taxes levied by State and Central governments. Online store owners also in a hunt to implement GST in their stores.

Recently we provided detailed tutorial on creating Indian GST Tax Rule in Magento, based on the comments, feedback and users’ requests for the same blog for Magento 2, I’m here with the detailed solution on creating Indian GST Tax Rule in Magento 2.

Since the launch of Magento 2, store owners having Magento 1 stores are migrating their stores in Magento 2 to leverage new features and functionality served by the version. Being the ruling developers of Magento 2, we would like to provide you with an easy method to implement GST in your Magento 2 and make your Magento 2 stores GST ready.

If you are confused with under which tax rate slab your products fall, government has also introduced an android app to calculate GST for the products you require.

Steps to create Indian GST Tax Rule in Magento 2

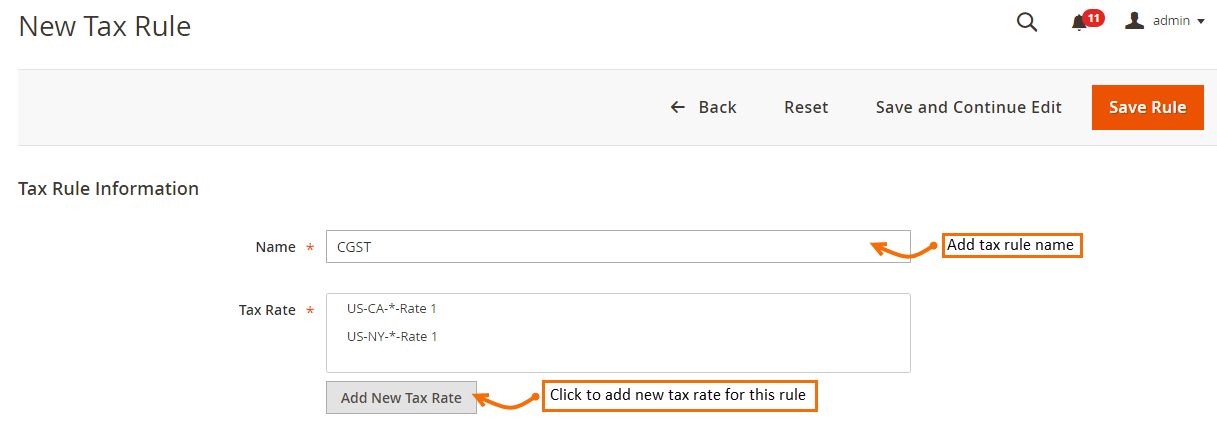

- First of all, create a new tax rule to apply GST tax to your store products. Go to Stores > Taxes > Tax Rules and click on “Add New Tax Rule”.

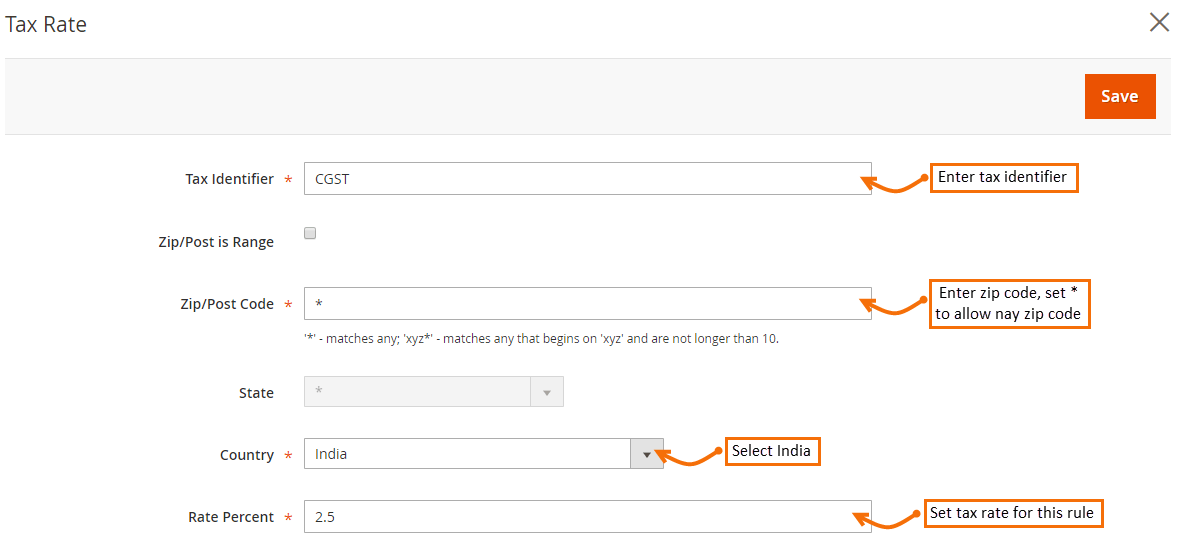

- While creating tax rule, you need to create tax rates for both SGST and CGST. All the Indian goods (products) and services are classified under 4 tax rates, those are 5%, 12%, 18% and 28% in which you have to look at tax rates to find your products fall under which category. Here, for example, we are implementing the tax rule for products fall under GST rates of 5% and thus we need to create SGST and CGST tax rules for 5%.

Note that CGST and SGST are equally divided to half of the amount of tax rate. So, here as the tax rate is 5%, CGST and SGST both will be divided equally i.e 2.5%. As the government rule specification, store owners and sellers have to bifurcate CGST and SGST taxes separately in the order details and invoices for each order made in the store.

Note that CGST and SGST are equally divided to half of the amount of tax rate. So, here as the tax rate is 5%, CGST and SGST both will be divided equally i.e 2.5%. As the government rule specification, store owners and sellers have to bifurcate CGST and SGST taxes separately in the order details and invoices for each order made in the store.

To bifurcate GST taxes to show separately in all the order related documents, go to Magento Root > vendor\magento\module-tax\view\frontend\web\template\checkout\summary\tax.html

At line no. 46, Find Code:<!-- ko if: $index() == 0 --> <td class="amount"> <!-- ko if: $parents[1].isCalculated() --> <span class="price" data-bind="text: $parents[1].formatPrice($parents[0].amount), attr: {'data-th': title, 'rowspan': $parents[0].rates.length }"></span>

Replace with:

<!-- ko if: $index() == 0 || $index() == 1 --> <td class="amount"> <!-- ko if: $parents[1].isCalculated() --> <span class="price" data-bind="text: $parents[1].formatPrice(($parents[0].amount/2)), attr: {'data-th': title, 'rowspan': $parents[0].rates.length

Note: Generally tax.html resides at the above path, but if you are using custom theme and have overwritten tax.html file, find it from your theme folder and replace the above code.

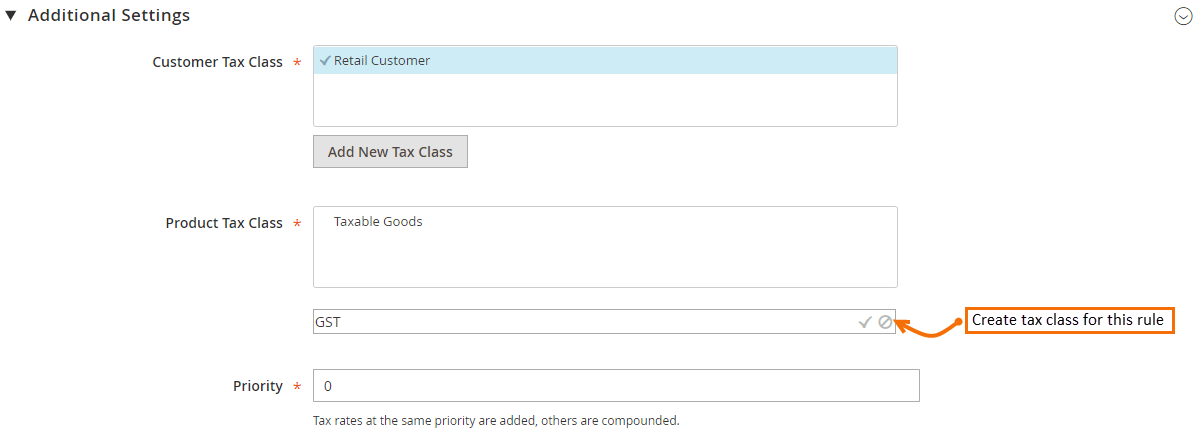

- Now click Additional Settings under which you will require to create product tax class for GST. Name your tax class as GST to easily identify it while applying tax rules to products.

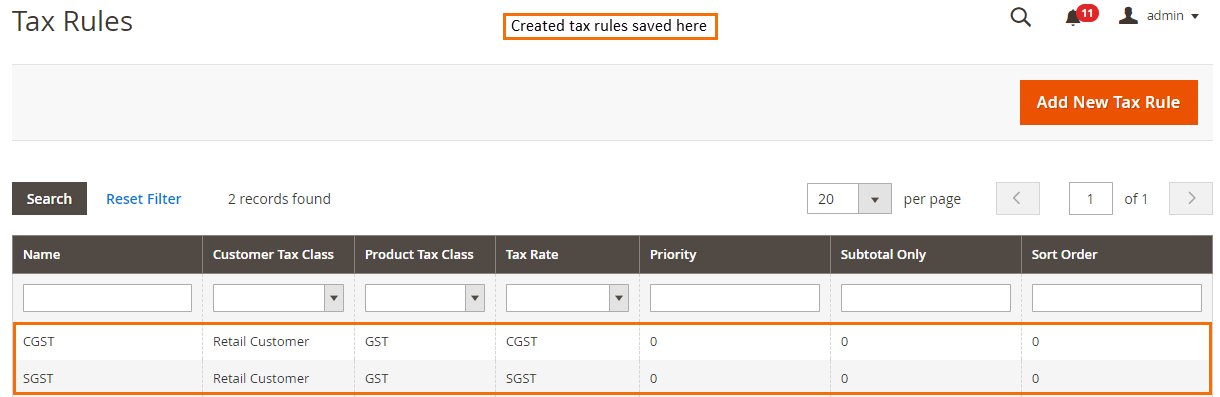

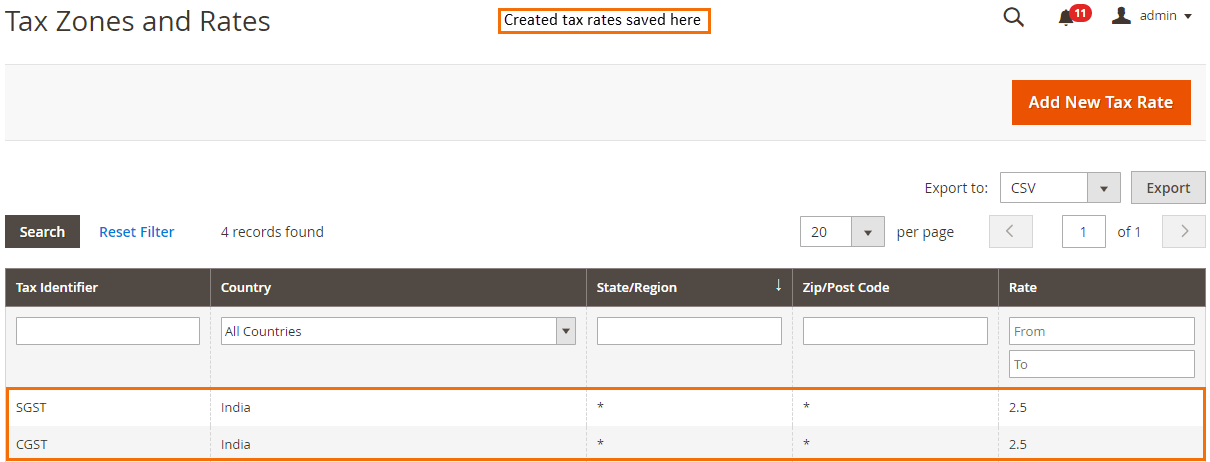

- Once you create and save both CGST and SGST tax rules, you can see them saved here.

- While creating tax rules, you have created tax rates for both CGST and SGST which can be seen enlisted under Stores > Taxes > Manage Tax Zones & Rates.

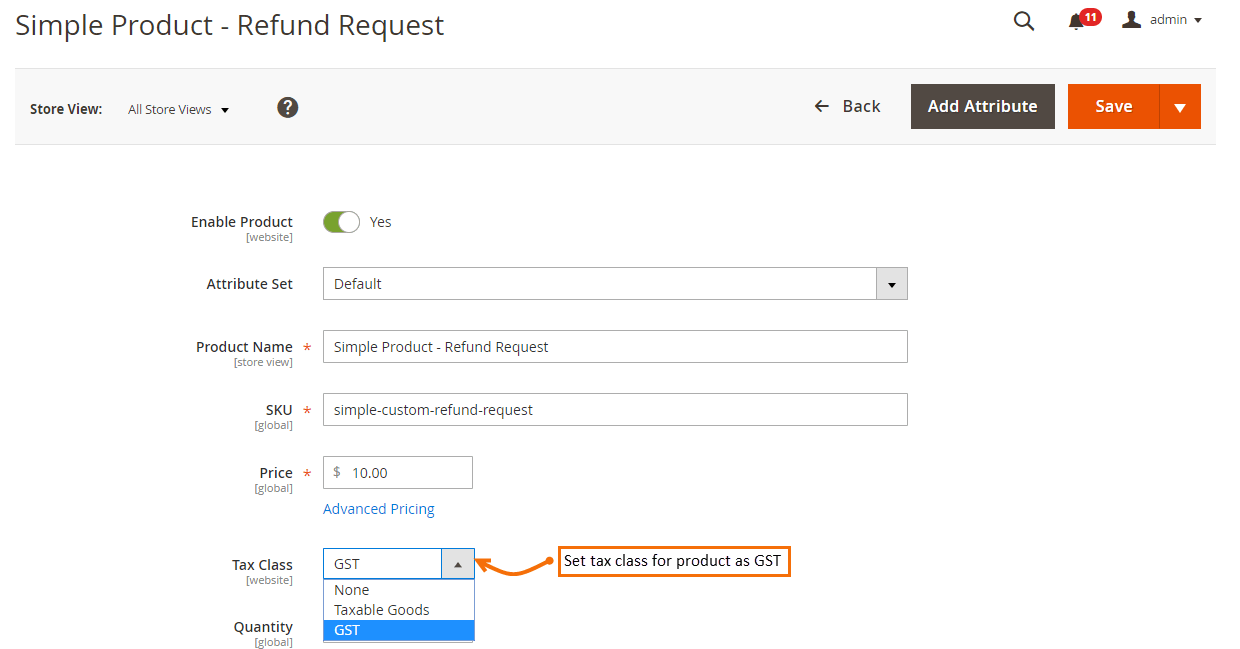

- Now go to Products > Catalog to assign tax classes to each products.

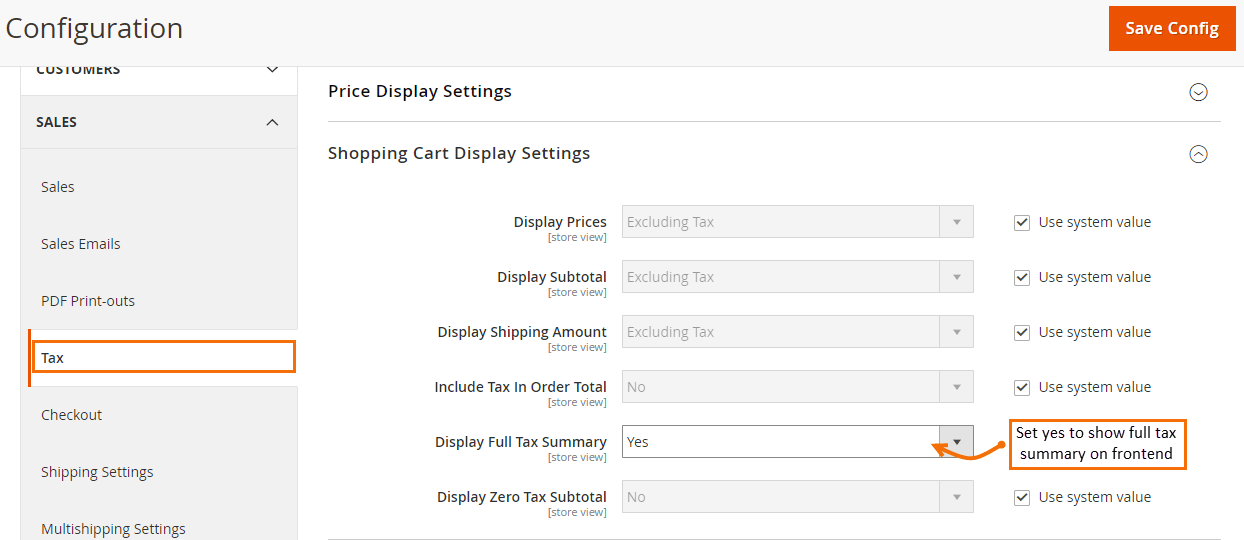

- Now go to Stores > Configuration > Sales > Tax > Shopping Cart Display Settings where set Yes to “Display Full Tax Summary” to easily display tax summary in detail.

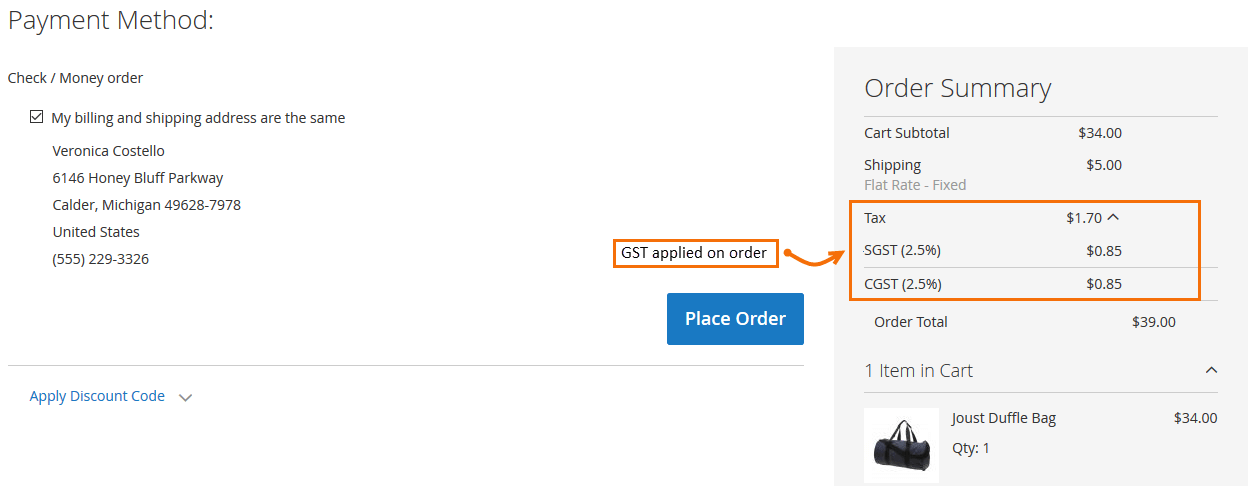

- Once everything is set and configured properly, you can add products to cart and see GST applied on order with bifurcation of both SGST and CGST.

Creating GST tax rules in Magento 2 is not a big deal. Following above steps properly will create GST rules in your Magento 2. Still if you stuck with something, let me know your query through commenting. I would be happy to help you regarding this.

Thank you! It works.

How you differentiate same state order products show sgst,cgst and other state show only IGST.

Thank You.

For your requirement you need to check our extension : https://magecomp.com/magento-2-indian-gst.html

Thank you! It works.

How you differentiate same state order products show sgst,cgst and other state show only IGST.

Thank You.

For your requirement you need to check our extension : https://magecomp.com/magento-2-indian-gst.html

Hi,

Please suggest something where product GST varying in product rate.

My problem is:

1) IGST – 5%( Below ₹1000), IGST – 12% (Above ₹1000) Pan India Applicable. Except for Kolkata city.

2) In case of Kolkata customers local purchase, CGST – 2.5% and SGST – 2.5%

Please suggest something that i solve the GST issues.

Thanks

Hi,

Please suggest something where product GST varying in product rate.

My problem is:

1) IGST – 5%( Below ₹1000), IGST – 12% (Above ₹1000) Pan India Applicable. Except for Kolkata city.

2) In case of Kolkata customers local purchase, CGST – 2.5% and SGST – 2.5%

Please suggest something that i solve the GST issues.

Thanks

Hello

We are developing GST extension for Magento2.

That feature we will add in our extension.

Hello,

There is no GST tax for the overseas countries, with in India only GST applied. So how can i apply gst like if customer order products from same state sgst and cgst and if customer order products from another state IGST applied? How can i differ CGST, SGST and IGST?

Thank You.

Hello,

There is no GST tax for the overseas countries, with in India only GST applied. So how can i apply gst like if customer order products from same state sgst and cgst and if customer order products from another state IGST applied? How can i differ CGST, SGST and IGST?

Thank You.

I t saved my time

I t saved my time

Followed all the steps. But only one value is showing in the frontend. In my case, only CGST value is showing , SGST is blank. Any idea ?

Verify that, you have properly created “SGST” Tax Rules as show in step-4.

Verify customer group which you assign while creating this,

Verify all other fields.

Followed all the steps. But only one value is showing in the frontend. In my case, only CGST value is showing , SGST is blank. Any idea ?

Verify that, you have properly created “SGST” Tax Rules as show in step-4.

Verify customer group which you assign while creating this,

Verify all other fields.

I am not getting tax details like CGST(2.5.%) SGST(2.5%) on frontend but it is properly visible at the backend .

I am not getting tax details like CGST(2.5.%) SGST(2.5%) on frontend but it is properly visible at the backend .