Recently the Indian government introduced GST tax in the market to replace all those different taxes and bunch them together under a single tax class. This tax is popularly known as GST – Goods and Services Tax, “One Nation One Tax”. It’s a common indirect tax for the whole nation applied right from the manufacturer to the consumer to make India a unified market. A robust and comprehensive IT system would be required to implement GST regime in India. Whole Ecommerce community is in a race to quick implement the tax rule to streamline with this new GST tax.

When it comes to Ecommerce, how can Magento be behind in this race to the win? As per the Magento, considering its popularity and usability in market, more than 250000 stores run on this platform. Being the ruling Magento developers, we have come with the easy guide to create GST tax rule in Magento to quick start implementing GST to your Magento products and services.

Let’s learn to create GST tax rule in Magento

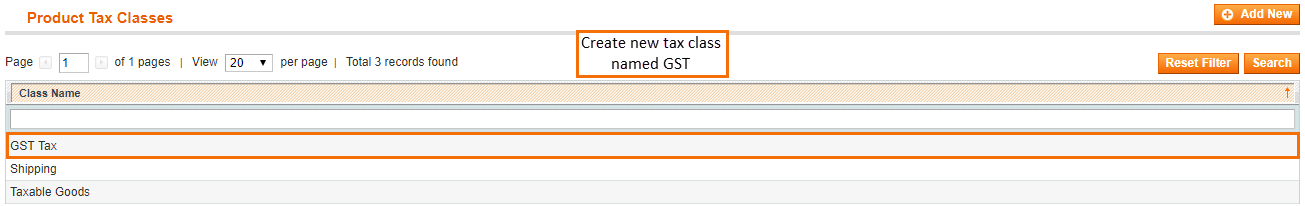

- First of all, create a new product tax class to easily identify while applying GST tax to the products. Go to Sales > Tax > Product Tax Classes and click on “Add New”. Name your tax class as GST to easily identify it while applying tax rules to products.

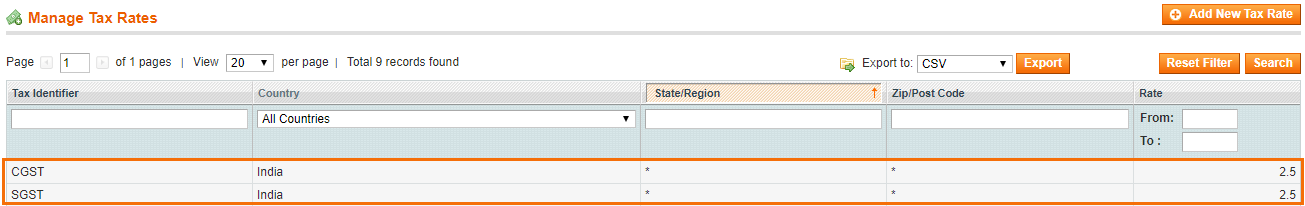

- Create tax rates for both SGST and CGST. Indian goods and services have been classified under 4 tax rates, those are 5%, 12%, 18% and 28%. Take a look at tax rates to find your products fall under which category. Here, we are implementing the tax rule on one of the clients selling fish & meats and thus their products fall under GST rates of 5% and thus we need to create SGST and CGST tax rules for 5%.

Go to Sales > Tax > Manage Tax Zones & Rates and click to Add New Tax Rate, and create tax rates for both CGST and SGST. Know that CGST and SGST are equally divided to half of the amount of tax rate. As per the rule declaration, store owners and sellers also need to bifurcate CGST and SGST taxes separately in the order details and invoices. So if the tax rate is 5%, you need to create SGST with 2.5% and CGST with 2.5% tax rates to show them separately in invoice.

Know that CGST and SGST are equally divided to half of the amount of tax rate. As per the rule declaration, store owners and sellers also need to bifurcate CGST and SGST taxes separately in the order details and invoices. So if the tax rate is 5%, you need to create SGST with 2.5% and CGST with 2.5% tax rates to show them separately in invoice.

To bifurcate GST taxes to show separately in all the order related documents, go to app\design\frontend\base\default\template\tax\order\tax.phtml,

Find below code:getValueProperties()?> rowspan=" 1 ">Copy the whole file and paste at app\design\frontend\[theme_package]\template\tax\order And replace code as shown below:

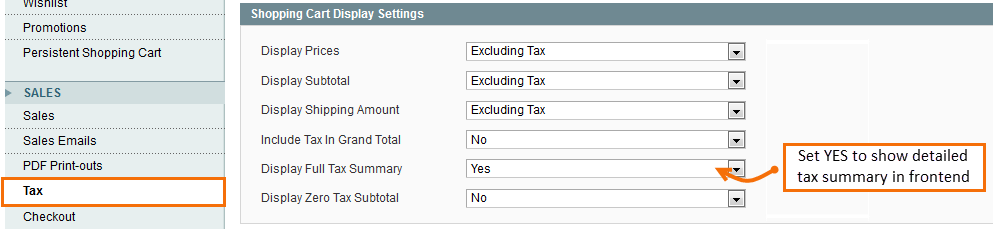

getValueProperties()?> rowspan=" 1 ">Now go to System -> Sales -> Tax -> Shopping Cart Display Setting and set Yes to Display Full Tax Summary.

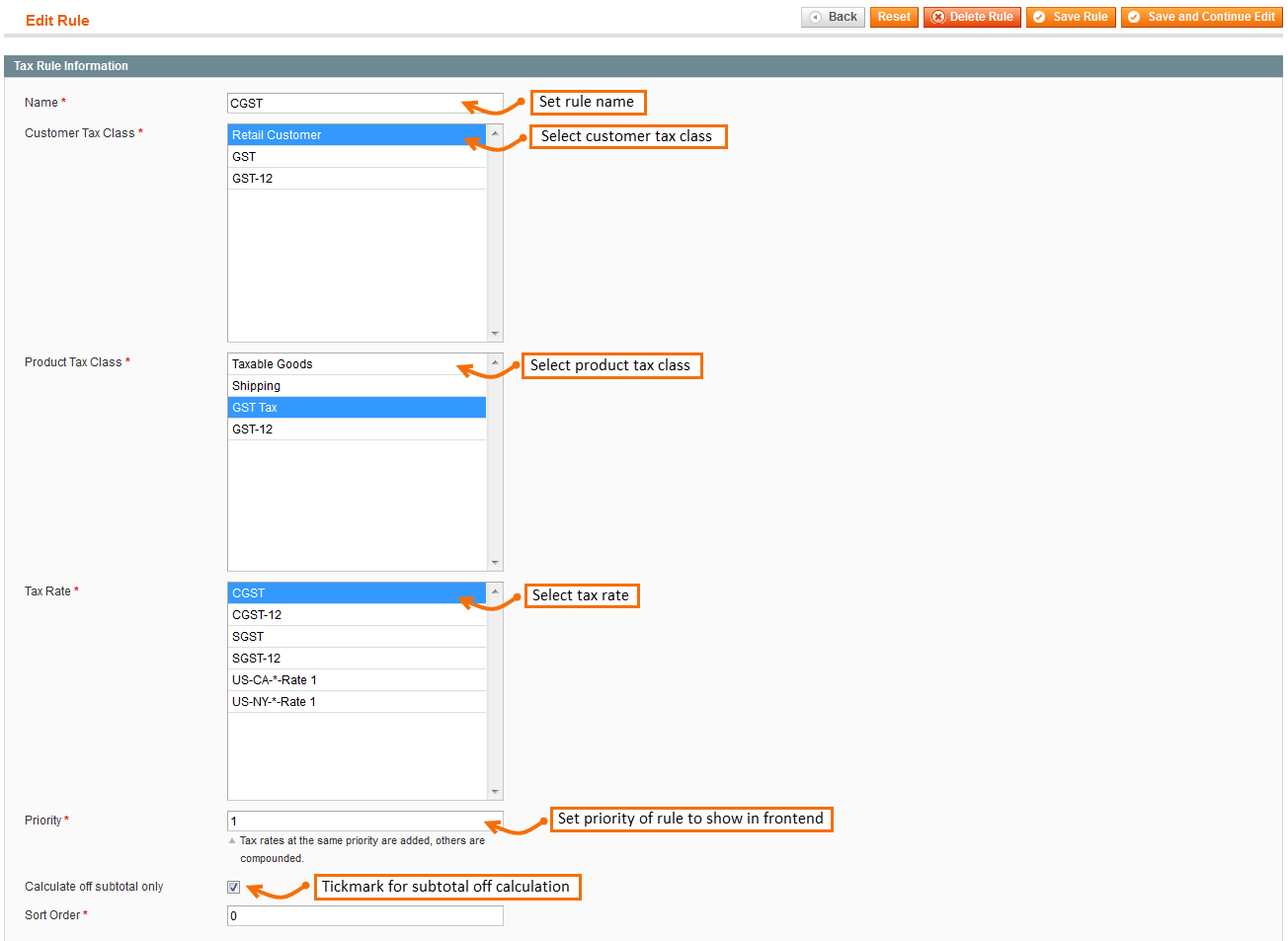

- Create new tax rules from Sales > Tax > Manage Tax Rules. Click on Create New and set each options as shown below.

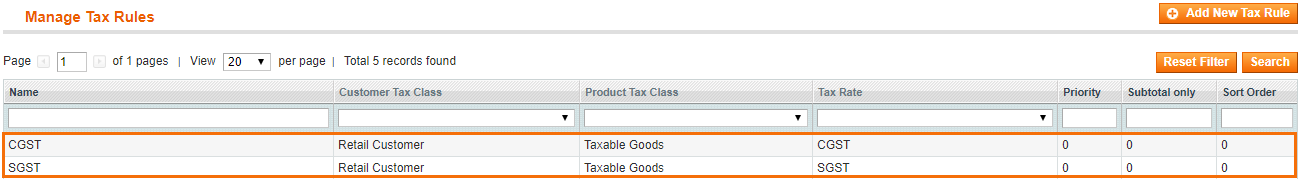

Once you create and save both the rules, you can see them enlisted.

Once you create and save both the rules, you can see them enlisted. - Now once you have created and saved GST tax rates and rules, you need to assign the tax class to your products. Here, we have only created tax rates for 5% but if you have wide range of products those fall under various tax rates, you need to create rates and rules for all and assign the related class to the products.

- So we are done with creating GST tax rules in Magento and once it’s assigned to the products, you can see the detailed tax charges with the bifurcation of SGST and CGST taxes in cart, checkout, invoice, credit memo, shipment, my account order view and Emails.

Understanding GST and creating tax rules in Magento is not rocket science but proper implementation can only lead to exact rules implementation and tax assignments. Above, I have tried to properly elaborate rules configuration along with the government terms and norms. Still if you have any questions or confusions regarding creating GST tax rules in Magento, don’t hesitate to contact me through commenting, I’ll be happy to help.

Hii Sir,

I am new in magento and i am working on GST section implementation above CGST AND SGST tax changes is not working in my site.Please help me.

Hello

Blog has very simple steps for the GST implementation,

We are launching the Magento Extension too in meantime,

You can ask us for Professional help by contacting us.

Hi

Its a great blog which helped me to implement GST to my magento website.Just Amazing.

But at the final step, ie., 5th point, am getting shipping and handling price and tax price but the bifurcation of SGST and CGST taxes are not shown.

At 4th point, Just INR is shown below the price and not the tax.

Can you help me to sort this out please…

To bifurcate GST taxes to show separately in all the order related documents,

go to appdesignfrontendbasedefaulttemplatetaxordertax.phtml,

Follow steps mentioned in blog.

For 4th point Query, You need to change following setting in System > configuration > Sales > Tax Calculation Setting > Catalog Prices Set to Including Tax

after that you can see Tax price in Product Price tab in backend

step 5: have done the same as shown, but no changes

step 4: Updated but its not showing the tax amount, but just showing [INR] [Inc. Tax]

Hii Sir,

I am new in magento and i am working on GST section implementation above CGST AND SGST tax changes is not working in my site.Please help me.

Hello

Blog has very simple steps for the GST implementation,

We are launching the Magento Extension too in meantime,

You can ask us for Professional help by contacting us.

Hello,

If we create new GST Tax Rule ,then we have to apply this new rule by opening every product on by one.

Or can i just create new on and assign on every product by just on click.

Please share your thoughts.

Thanks in Advance.

Regards,

Munish.

You can use actions for multiple products edit.

How to do it?

Hi

Its a great blog which helped me to implement GST to my magento website.Just Amazing.

But at the final step, ie., 5th point, am getting shipping and handling price and tax price but the bifurcation of SGST and CGST taxes are not shown.

At 4th point, Just INR is shown below the price and not the tax.

Can you help me to sort this out please…

To bifurcate GST taxes to show separately in all the order related documents,

go to app\design\frontend\base\default\template\tax\order\tax.phtml,

Follow steps mentioned in blog.

For 4th point Query, You need to change following setting in System > configuration > Sales > Tax Calculation Setting > Catalog Prices Set to Including Tax

after that you can see Tax price in Product Price tab in backend

step 5: have done the same as shown, but no changes

step 4: Updated but its not showing the tax amount, but just showing [INR] [Inc. Tax]

You can contact us for professional help in that case. There must be any issue need to check.

We have updated the blog,

Some configurations, you must be missing, we have added those in blogs now,

Please check and share your thoughts.

Wow, awesome.

Works perfect.

Thanks a lot for such a helpful blog.

Hello,

If we create new GST Tax Rule ,then we have to apply this new rule by opening every product on by one.

Or can i just create new on and assign on every product by just on click.

Please share your thoughts.

Thanks in Advance.

Regards,

Munish.

You can use actions for multiple products edit.

How to do it?

Hey,

You can use a CSV file for Bulk product updates rather than adding each product one by one in the admin panel. Make a CSV file with two columns “sku” and “tax_class_id”

Regards,

Thanks for the support

Hey,

I have followed your step which you mentioned above, My theme supports the base file for taxation, so I have modified the base file. (appdesignfrontendbasedefaulttemplatetaxordertax.phtml)

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount / ($percent/(float)$rate[‘percent’]) ); ?>

but still CGST AND SGST tax isn’t showing separate just “TAX” showing and also back-end price showing [INR] [Inc. Tax]

Thanks in advance

Regards,

This is what even am getting…

Just waiting for some help to sort it out soon.

We have updated the blog,

Some configurations, you must be missing, we have added those in blogs now,

Please check and share your thoughts.

We have updated the blog,

Some configurations, you must be missing, we have added those in blogs now,

Please check and share your thoughts.

Great! it’s worked

Hey,

I have followed your step which you mentioned above, My theme supports the base file for taxation, so I have modified the base file. (app\design\frontend\base\default\template\tax\order\tax.phtml)

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount / ($percent/(float)$rate[‘percent’]) ); ?>

but still CGST AND SGST tax isn’t showing separate just “TAX” showing and also back-end price showing [INR] [Inc. Tax]

Thanks in advance

Regards,

This is what even am getting…

Just waiting for some help to sort it out soon.

We have updated the blog,

Some configurations, you must be missing, we have added those in blogs now,

Please check and share your thoughts.

Wow, awesome.

Works perfect.

Thanks a lot for such a helpful blog.

Hi, I have done same step and it didn’t worked for me. How to select bifurcated GST rate for particular product?

Hello

This blog only supports CGST and SGST for same GST slab for all over the store products.

To apply GST by category or by product, please checkout our extension, https://magecomp.com/magento-indian-gst.html

Hi Sandy, I am experiencing below issue:

The issue is how I can select the tax in “Price” tab in the product. Here I can select only one tax at a time(one of the bifurcated tax). After 4th step you have missed one step which is selecting the TAX rate. please help me to resolve this.

We have updated the blog,

Some configurations, you must be missing, we have added those in blogs now,

Please check and share your thoughts.

Great! it’s worked

Nice post. Thanks! But this is not enough for setting up GST.

If transaction is inter-state we need to levy IGST. This is not possible in your solution I guess.

Also you have not mentioned the concept of HSNs.

We have launched GST extension for Magento1 for enhanced functionality of GST.

Take a look at,

https://magecomp.com/magento-indian-gst.html

Nice post. Thanks! But this is not enough for setting up GST.

If transaction is inter-state we need to levy IGST. This is not possible in your solution I guess.

Also you have not mentioned the concept of HSNs.

We have launched GST extension for Magento1 for enhanced functionality of GST.

Take a look at,

https://magecomp.com/magento-indian-gst.html

Hi…

Thanks for the information!

Please explain how to apply GST on Shipping & Handling Charges too. As per GST Rule we need to charge GSt on Shipping also with the same rate of Tax as is applicable on the chosen product in the cart/order.

First of all, create a tax class for shipping and handling charges. Now create a tax rule to for the tax class particularly for GST. Now go to System –> Configuration –> Sales –> tax –> Tax classes and select created tax class from dropdown under Tax Class for Shipping.

Hi, I have done as you said in blog. The issue is how I can select the tax in “Price” tab in the product. Here I can select only one tax at a time(one of the bifurcated tax). After 4th step you have missed one step which is selecting the TAX rate. please help me to resolve this.

please reply to this

If you want to apply GST by product, then you will have to purchase our GST extension,

That can help you to set up GST by category, by product or store wise.

Hi…

Thanks for the information!

Please explain how to apply GST on Shipping & Handling Charges too. As per GST Rule we need to charge GSt on Shipping also with the same rate of Tax as is applicable on the chosen product in the cart/order.

First of all, create a tax class for shipping and handling charges. Now create a tax rule to for the tax class particularly for GST. Now go to System –> Configuration –> Sales –> tax –> Tax classes and select created tax class from dropdown under Tax Class for Shipping.

Hi, I have done as you said in blog. The issue is how I can select the tax in “Price” tab in the product. Here I can select only one tax at a time(one of the bifurcated tax). After 4th step you have missed one step which is selecting the TAX rate. please help me to resolve this.

please reply to this

If you want to apply GST by product, then you will have to purchase our GST extension,

That can help you to set up GST by category, by product or store wise.

I followed this link clearly , i am facing issue that CGST and SCGT are not displaying proper values only in Backend Order View page , but its working fine in all other pages like backend invoice page and frontend checkout, cart pages , i posted question here also : https://magento.stackexchange.com/questions/183713/wrong-tax-values-are-displaying-in-order-view-page Please help me

Hello

You should try out our GST extension to make it hassle free

https://magecomp.com/magento-indian-gst.html

I followed this link clearly , i am facing issue that CGST and SCGT are not displaying proper values only in Backend Order View page , but its working fine in all other pages like backend invoice page and frontend checkout, cart pages , i posted question here also : https://magento.stackexchange.com/questions/183713/wrong-tax-values-are-displaying-in-order-view-page Please help me

Hello

You should try out our GST extension to make it hassle free

https://magecomp.com/magento-indian-gst.html

Helpful and beneficial post! I implemented it on one of the Indian stores I was maintaining.

Glad to hear that we can help 🙂

Helpful and beneficial post! I implemented it on one of the Indian stores I was maintaining.

Glad to hear that we can help 🙂

Hello,

How to set my gst percentage?

Hello,

How to set my gst percentage?

Nice Post. Thanks for your Support.

I have one issue for Fashion ecommerce site.

Here if subtotal is below 1000 then GST is 5% and above 1000 its 18%.

Let me know can we achieve it.

It requires customization or custom extension to fulfill your requirements.

You Can create another tax class for below 1000 products and apply it.

Nice Post. Thanks for your Support.

I have one issue for Fashion ecommerce site.

Here if subtotal is below 1000 then GST is 5% and above 1000 its 18%.

Let me know can we achieve it.

It requires customization or custom extension to fulfill your requirements.

You Can create another tax class for below 1000 products and apply it.

Very Helpfull

Very Helpfull

i m using it in my site but its not showing..

You must be missing any step from our blog or setting, please confirm.

i m using in magento 1.9 i dont want to go for paid plugin so plz tell solution.

For CGST and SGST set up, our blog can help.

For IGST set up, you will have to go with our paid extension

https://magecomp.com/magento-indian-gst.html

i m using it in my site but its not showing..

You must be missing any step from our blog or setting, please confirm.

i m using in magento 1.9 i dont want to go for paid plugin so plz tell solution.

For CGST and SGST set up, our blog can help.

For IGST set up, you will have to go with our paid extension

https://magecomp.com/magento-indian-gst.html

It’s Works perfect. Thank you. but I need one help from you all. I am new to Magento. I created one E-commerce website using Magento 1.9 version. I assigned free shipping for particular products and also assigned “Shipping rates for other products using Tablerates” based on weight vs destination. While select product from both the criterias. It accept free shipping only not Tablerates. Kindly check the below link and let me know, is their any possibility to avoid conflict of free shipping and tablerates. Because we want free shipping only for applied products if i select free shipping product and other non free shipping products means it should show shipping rates not zero rate.

My client has different GST with different products. How can I create multiple rules?

You can create different Tax Class and Rules and select Tax class in each products respectively.

You can also use our GST extension, which will make your job much simple.

https://magecomp.com/magento-indian-gst.html

My client has different GST with different products. How can I create multiple rules?

You can create different Tax Class and Rules and select Tax class in each products respectively.

You can also use our GST extension, which will make your job much simple.

https://magecomp.com/magento-indian-gst.html

I think appdesignfrontendbasedefaulttemplatetaxordertax.phtml this is not a right template we need to make changes in appdesignfrontendbasedefaulttemplatetaxcheckouttax.phtml

I think app\design\frontend\base\default\template\tax\order\tax.phtml this is not a right template we need to make changes in app\design\frontend\base\default\template\tax\checkout\tax.phtml

Hello in above you are using GST 5% but i want to use all tax classes like 5 % 12% 18% and 28% how to setup that….?

You can create different Tax class and assign them to the products according to Rate.

Hello in above you are using GST 5% but i want to use all tax classes like 5 % 12% 18% and 28% how to setup that….?

You can create different Tax class and assign them to the products according to Rate.

Thanks for the information about GST tax rules .

Thanks for the information about GST tax rules .

Hello, I follow all the steps but its not working can you please help me ?

Where is the issue you are facing?

Hello, I follow all the steps but its not working can you please help me ?

Where is the issue you are facing?

I have followed the instructions .. And have been able to set up the tax classes .. but the Tax calculated isnt correct ..

Sending Cards PABD103 1 ₹117.19

Subtotal ₹117.19 (correct)

Cash on Delivery fee ₹100.00 (price including Tax)

Shipping & Handling ₹84.75 (excl Tax)

Grand Total (Excl.Tax) ₹286.69 (amount is correct)

ROI_CGST_14% (14%) ₹16.41 (correct)

ROI_SGST_14% (14%) ₹14.39 (incorrect should be 16.41)

CGST_Shipping (9%) ₹5.87 (incorrect should be 7.625)

SGST_Shipping (9%) ₹5.87 (incorrect should be 7.625)

SGST_COD (9%) ₹4.97 (incorrect should be 7.625)

CGST_COD (9%) ₹4.97(incorrect should be 7.625)

Tax ₹63.31 (correct)

Grand Total (Incl.Tax) ₹350.00 (correct)

Hi ,

First of all a good blog.

i am getting the values right for example i have given cgst and sgst 1.5% and the values are adding to the price.

but one thing is in my cart page its not differentiating CGST and SGST its showing general Name “Tax “and showing both combined price 1.5+ 1.5% value.I have added the code in tax.phtml still its not workign anybody can help.

I have followed the instructions .. And have been able to set up the tax classes .. but the Tax calculated isnt correct ..

Sending Cards PABD103 1 ₹117.19

Subtotal ₹117.19 (correct)

Cash on Delivery fee ₹100.00 (price including Tax)

Shipping & Handling ₹84.75 (excl Tax)

Grand Total (Excl.Tax) ₹286.69 (amount is correct)

ROI_CGST_14% (14%) ₹16.41 (correct)

ROI_SGST_14% (14%) ₹14.39 (incorrect should be 16.41)

CGST_Shipping (9%) ₹5.87 (incorrect should be 7.625)

SGST_Shipping (9%) ₹5.87 (incorrect should be 7.625)

SGST_COD (9%) ₹4.97 (incorrect should be 7.625)

CGST_COD (9%) ₹4.97(incorrect should be 7.625)

Tax ₹63.31 (correct)

Grand Total (Incl.Tax) ₹350.00 (correct)

Hi ,

First of all a good blog.

i am getting the values right for example i have given cgst and sgst 1.5% and the values are adding to the price.

but one thing is in my cart page its not differentiating CGST and SGST its showing general Name “Tax “and showing both combined price 1.5+ 1.5% value.I have added the code in tax.phtml still its not workign anybody can help.

Please help me this step. I have to change code in base file or theme file?

I am confused. Please help

appdesignfrontendbasedefaulttemplatetaxordertax.phtml,

Find below code:

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount); ?>

1

2

3

4

5

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount); ?>

Copy the whole file and paste at appdesignfrontend[theme_package]templatetaxorder And replace code as shown below:

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount / ($percent/(float)$rate[‘percent’]) ); ?>

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount / ($percent/(float)$rate[‘percent’]) ); ?>

Please help me this step. I have to change code in base file or theme file?

I am confused. Please help

app\design\frontend\base\default\template\tax\order\tax.phtml,

Find below code:

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount); ?>

1

2

3

4

5

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount); ?>

Copy the whole file and paste at app\design\frontend\[theme_package]\template\tax\order And replace code as shown below:

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount / ($percent/(float)$rate[‘percent’]) ); ?>

<td getValueProperties()?> rowspan=” 1 “>

formatPrice($amount / ($percent/(float)$rate[‘percent’]) ); ?>

Hi, After successfully, Place code and settings, IGST working fine, but if we can check in SGST and CGST system calculate SGST+CGST+IGST, Kindly assist where i am missing in configuration.

Try our GST extension for IGST, SGST and CGST.

SIR THIS BLOG IS VERY GOOD AND FOLLOWING THE INSTRUCTIONS OF YOUR BLOG I SUCCESSFULLY APPLY GST IN MY WEBSITE. SIR THANK YOU SOO MUCH FOR CREATING THIS BLOG.

Glad to know it helped you! Stay tuned for more. 🙂

Nice and useful Post.

Nice and useful Post.

It’s Works perfect. Thank you. but I need one help from you all. I am new to Magento. I created one E-commerce website using Magento 1.9 version. I assigned free shipping for particular products and also assigned “Shipping rates for other products using Tablerates” based on weight vs destination. While select product from both the criterias. It accept free shipping only not Tablerates. Kindly check the below link and let me know, is their any possibility to avoid conflict of free shipping and tablerates. Because we want free shipping only for applied products if i select free shipping product and other non free shipping products means it should show shipping rates not zero rate.

Hi, After successfully, Place code and settings, IGST working fine, but if we can check in SGST and CGST system calculate SGST+CGST+IGST, Kindly assist where i am missing in configuration.

Try our GST extension for IGST, SGST and CGST.

SIR THIS BLOG IS VERY GOOD AND FOLLOWING THE INSTRUCTIONS OF YOUR BLOG I SUCCESSFULLY APPLY GST IN MY WEBSITE. SIR THANK YOU SOO MUCH FOR CREATING THIS BLOG.

Glad to know it helped you! Stay tuned for more. 🙂