Digital payments have transformed how we pay for our purchases, enabling speed, safety, and convenience in those financial exchanges. One of the top advantages of digital payment is that it is supported on mobile and desktop devices with digital wallets and contactless cards.

Digital payments have replaced conventional cash and cheque methods. This change has streamlined payment processes across all industries, allowing consumers to buy anything, anywhere, anytime.

The rise of online shopping, mobile banking, and peer-to-peer payment platforms has increased the reach of digital payments and improved user experience, leading to a move toward a cashless society. It means greater efficiency and reduced transaction times for both businesses and consumers.

Today, in this blog, we will look into the insightful statistics about digital payments to help you know where our technology has reached.

Interesting UPI Statistics You Need to Know in 2025 – A MageComp Edition

Top Digital Payment Statistics

- In 2024, the total value of digital payment transactions worldwide reached approximately $8.5 trillion, reflecting a substantial increase from previous years.

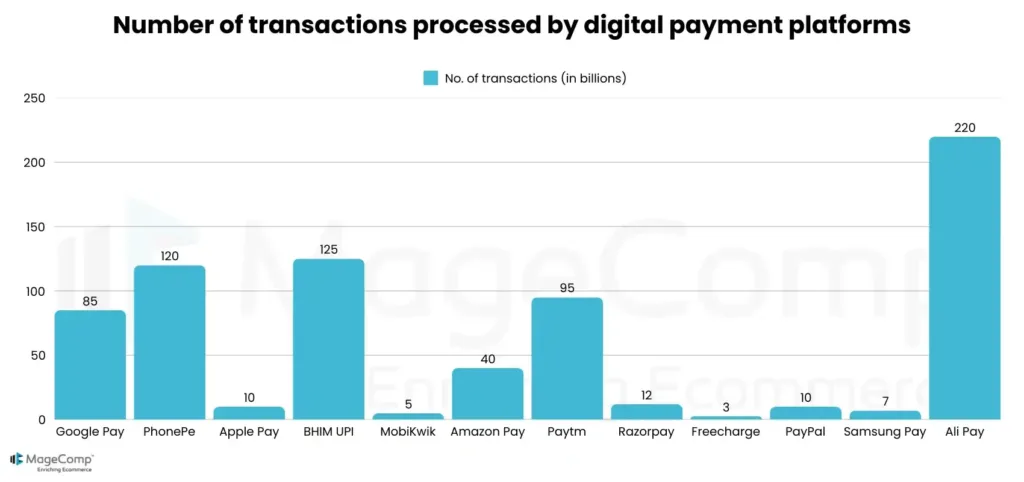

- India recorded 208.5 billion digital payment transactions in 2024, highlighting the country’s rapid adoption of digital payment methods.

- The Unified Payments Interface (UPI) accounted for 83% of India’s total digital payment volume in 2024, up from 34% in 2019.

- India’s real-time payment transactions constitute about 49% of the global total, underscoring its leadership in digital payment adoption.

- As of 2024, over 2 billion people worldwide are using digital wallets, a 10% increase from the previous year.

- Digital wallets account for 50% of global e-commerce transactions, reflecting their growing importance in online shopping.

- In 2024, mobile payments represented 30% of all digital payment transactions globally, indicating a shift towards mobile platforms.

- In 2023, global losses due to digital payment fraud amounted to $32 billion, highlighting the need for enhanced security measures.

- The digital payment industry generated $1.5 trillion in revenue in 2024, a 15% increase from the previous year.

- Contactless payments accounted for 40% of in-store transactions in 2024, reflecting consumer preference for quick and secure payment methods.

General Digital Payment Statistics

- As of 2024, 75% of adults worldwide have adopted some form of digital payment method.

- Emerging markets have seen a 20% year-over-year increase in digital payment adoption, driven by mobile payment solutions.

- The global volume of digital payment transactions reached 1.2 trillion in 2024, a 12% increase from the previous year.

- In 2024, 65% of retail transactions globally were conducted through digital payment methods.

- The Asia-Pacific region experienced a 25% increase in digital payment transactions in 2024, driven by countries like China and India.

- In 2024, 80% of Europeans used digital payment methods, with a significant rise in mobile payment usage.

- In 2024, 85% of North Americans used digital payment methods, with a notable increase in contactless payments.

- In 2024, 70% of Latin Americans used digital payment methods, with mobile payments being the most popular.

- In 2024, 60% of Africans used digital payment methods, with mobile money services leading the adoption.

- In 2024, 75% of Middle Eastern consumers used digital payment methods, with a significant rise in mobile wallet usage.

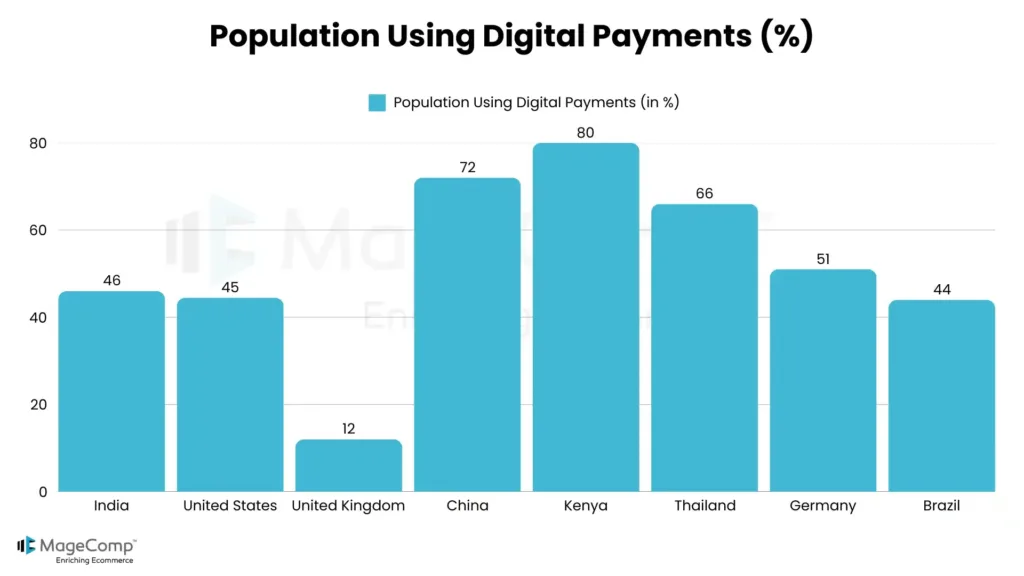

Digital Payment Usage Statistics

- In 2024, mobile payment transactions accounted for 35% of all digital payment transactions globally.

- Digital wallets were used for 50% of online purchases in 2024, indicating a strong preference for this payment method.

- Peer-to-peer payment services saw a 30% increase in usage in 2024, with over 500 million users worldwide.

- QR code payments grew by 40% in 2024, with over 1 billion users globally.

- Contactless payments accounted for 45% of in-store transactions in 2024, reflecting consumer preference for quick and secure payment methods.

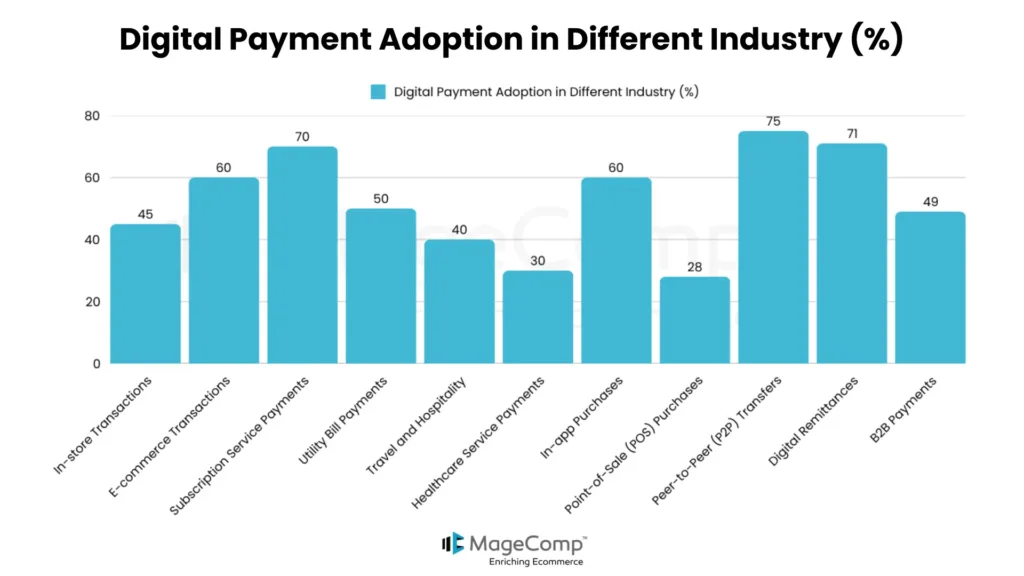

- Digital payments represented 60% of all e-commerce transactions in 2024, a 10% increase from the previous year.

- Digital payment methods were used for 70% of subscription service payments in 2024, indicating a shift from traditional billing methods.

- Digital payments accounted for 50% of utility bill payments in 2024, reflecting convenience and efficiency.

- Digital payments represented 40% of transactions in the travel and hospitality industry in 2024.

- Digital payments accounted for 30% of healthcare service payments in 2024, a 15% increase from the previous year.

Digital Payment Fraud Statistics

- In 2023, global losses due to digital payment fraud amounted to $32 billion, highlighting the need for enhanced security measures.

- Digital payment fraud incidents increased by 15% in 2024 compared to the previous year.

- Mobile payment fraud has grown by 18% in 2024, with an estimated $7.5 billion in losses. This underscores the need for better fraud prevention on mobile platforms.

- Credit card fraud in digital payments accounted for 50% of the total payment fraud losses in 2023. This figure is expected to increase by 8% in 2024.

- Account takeover fraud in digital payments rose by 22% in 2024 as cybercriminals increasingly target digital wallets and payment apps.

- Social engineering scams, which trick consumers into revealing payment information, accounted for 12% of all digital payment fraud in 2024.

- Fraud in card-not-present (CNP) transactions decreased by 5% in 2024 due to the increased use of tokenization and other security features in digital payments.

- The number of mobile payment fraud incidents involving phishing attacks has grown by 25% in 2024.

- Blockchain-based digital payments are expected to reduce fraud by 40% by 2025, as they offer improved transparency and security.

- Biometric authentication (e.g., face and fingerprint recognition) is expected to reduce digital payment fraud by 30% in 2024 as more institutions implement these systems.

Revenue Generated Through Digital Payments

- In 2024, the digital payments sector generated $1.5 trillion in global revenue, a 15% increase from 2023.

- Mobile payment services are expected to generate $1 trillion in revenue globally in 2024, accounting for nearly 70% of digital payment revenue.

- Digital wallet services are projected to generate $220 billion in global revenue in 2024.

- Cross-border digital payments are projected to reach $150 billion in 2024, driven by globalization and increased use of digital payment platforms.

- E-commerce platforms generated $300 billion in digital payment revenue in 2024, with a 10% growth from the previous year.

- Subscription-based digital payments accounted for $110 billion in revenue in 2024, growing rapidly due to the rise of subscription services.

- Peer-to-peer payment services, such as Venmo and Zelle, generated $80 billion in global revenue in 2024.

- QR code payments generated $50 billion in revenue globally in 2024, driven by their adoption in Asia.

- In-store digital payment methods, including contactless and mobile wallets, generated $400 billion in revenue globally in 2024.

- Cryptocurrency payments accounted for $35 billion in revenue in 2024, reflecting a growing acceptance of digital currencies in mainstream commerce.

Most Popular Digital Payment Methods

- UPI continues to be the most widely used digital payment method in India, accounting for 83% of all digital payments in 2024.

- Credit and debit cards remain the most popular digital payment method globally, accounting for 40% of digital payment transactions in 2024.

- Digital wallets such as PayPal, Apple Pay, and Google Pay are used in 50% of global e-commerce transactions in 2024.

- QR code payments are gaining popularity, with China being the leader, where they account for 40% of all digital payments.

- Contactless payments are now used for 45% of all in-store transactions globally in 2024.

- Mobile payments, particularly through apps like Alipay and WeChat Pay, make up 30% of the global digital payment volume in 2024.

- Cryptocurrency payments have grown in popularity, accounting for 2% of global digital payments in 2024.

- Services like Venmo and Zelle saw continued growth, representing 5% of global digital payment usage in 2024.

- Bank transfers are still widely used, particularly in Europe, representing 20% of digital payment methods in 2024.

- BNPL services grew rapidly in 2024, representing 6% of digital payments in key markets like the U.S. and the UK.

The Shift from Digital Payment to Mobile Payment Statistics

- Mobile payments are expected to account for 35% of all digital payment transactions in 2024, reflecting the shift toward smartphones.

- Over 2 billion people globally are expected to use mobile payments by 2024, up from 1.5 billion in 2023.

- In emerging markets, mobile payments will account for 40% of digital payment transactions by 2024.

- Mobile wallets are projected to reach $1 trillion in global transaction value by 2024, marking a significant shift toward mobile-first payment solutions.

- The transaction volume of mobile payments worldwide is expected to exceed $2 trillion in 2024.

- In North America, 70% of consumers are expected to use mobile payments in 2024, reflecting a shift away from traditional payment methods.

- Near Field Communication (NFC) technology is projected to account for 50% of mobile payment transactions in 2024.

- In Europe, mobile payments are expected to increase by 25% in 2024, driven by NFC-enabled smartphones.

- Consumers’ preference for mobile payments has led to a 40% decrease in the use of cash for digital transactions in 2024.

- In Latin America, mobile payments are expected to grow by 30% in 2024, surpassing traditional card-based payments for many consumers.

Wrap Up

The surge in digital transactions is revolutionizing the online marketplace, reshaping how businesses operate and interact with customers. As a business owner, it is crucial to embrace this trend early to meet the evolving preferences of your clientele.

By integrating various payment options, such as digital wallets, contactless payments, and online banking, you can create a more convenient and efficient shopping experience. This not only enhances customer satisfaction but also increases the likelihood of repeat business, as consumers appreciate the flexibility and ease of managing their transactions.

Additionally, staying ahead of the curve with robust digital transaction systems will position your business favorably in a competitive landscape.

Other Statistics Blogs

80+ Unbelievable Facts and Stats About ChatGPT

Jaw-Dropping Google Search Statistics and Facts

Content Management System (CMS) Statistics You Need to Know

35+ Squarespace Statistics for 2025: Fascinating Facts & Figures

30+ Google Analytics Statistics & Usage

100+ Artificial Intelligence Statistics That Will Blow Your Mind – MageComp Edition

70+ Email Marketing Statistics that You Should Know – A MageComp Report

Magento Statistics – Market Share, Usage and Revenue Growth

WooCommerce Statistics and Trends

Wix Statistics – Market Share & Usage – A MageComp Report

Shopify App Store Statistics You Need to Know – A MageComp Report

Instagram Threads’ Statistics: Impact on Social Media Trends

Unbelievable Bing Statistics – Revenue, Usage and Market Share